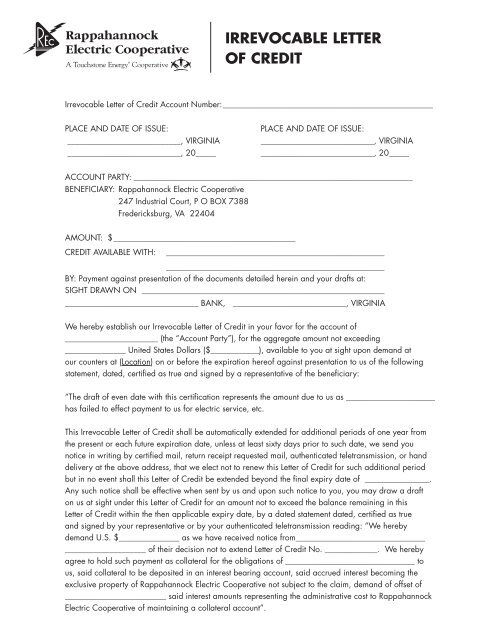

IRREVOCABLE LETTER OF CREDIT

irrevocable letter of credit - Rappahannock Electric Cooperative

irrevocable letter of credit - Rappahannock Electric Cooperative

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>IRREVOCABLE</strong> <strong>LETTER</strong><br />

<strong>OF</strong> <strong>CREDIT</strong><br />

Irrevocable Letter of Credit Account Number:____________________________________________________<br />

PLACE AND DATE <strong>OF</strong> ISSUE:<br />

____________________________, VIRGINIA<br />

____________________________, 20_____<br />

PLACE AND DATE <strong>OF</strong> ISSUE:<br />

____________________________, VIRGINIA<br />

____________________________, 20_____<br />

ACCOUNT PARTY:______________________________________________________________________<br />

BENEFICIARY: Rappahannock Electric Cooperative<br />

247 Industrial Court, P O BOX 7388<br />

Fredericksburg, VA 22404<br />

AMOUNT: $_____________________________________________<br />

<strong>CREDIT</strong> AVAILABLE WITH: _______________________________________________________<br />

_______________________________________________________<br />

BY: Payment against presentation of the documents detailed herein and your drafts at:<br />

SIGHT DRAWN ON _____________________________________________________________<br />

_________________________________ BANK, ____________________________, VIRGINIA<br />

We hereby establish our Irrevocable Letter of Credit in your favor for the account of<br />

_______________________ (the “Account Party”), for the aggregate amount not exceeding<br />

_______________ United States Dollars ($____________), available to you at sight upon demand at<br />

our counters at (Location) on or before the expiration hereof against presentation to us of the following<br />

statement, dated, certified as true and signed by a representative of the beneficiary:<br />

“The draft of even date with this certification represents the amount due to us as ______________________<br />

has failed to effect payment to us for electric service, etc.<br />

This Irrevocable Letter of Credit shall be automatically extended for additional periods of one year from<br />

the present or each future expiration date, unless at least sixty days prior to such date, we send you<br />

notice in writing by certified mail, return receipt requested mail, authenticated teletransmission, or hand<br />

delivery at the above address, that we elect not to renew this Letter of Credit for such additional period<br />

but in no event shall this Letter of Credit be extended beyond the final expiry date of ________________.<br />

Any such notice shall be effective when sent by us and upon such notice to you, you may draw a draft<br />

on us at sight under this Letter of Credit for an amount not to exceed the balance remaining in this<br />

Letter of Credit within the then applicable expiry date, by a dated statement dated, certified as true<br />

and signed by your representative or by your authenticated teletransmission reading: “We hereby<br />

demand U.S. $_______________ as we have received notice from________________________________<br />

____________________ of their decision not to extend Letter of Credit No. _____________. We hereby<br />

agree to hold such payment as collateral for the obligations of ________________________________ to<br />

us, said collateral to be deposited in an interest bearing account, said accrued interest becoming the<br />

exclusive property of Rappahannock Electric Cooperative not subject to the claim, demand of offset of<br />

_________________________ said interest amounts representing the administrative cost to Rappahannock<br />

Electric Cooperative of maintaining a collateral account”.

In the event that this Letter of Credit is automatically extended beyond its present expiration date in<br />

accordance with the terms and conditions of this Letter of Credit, the aggregate amount available under this<br />

Letter of Credit shall be automatically reduced in accordance with the following schedule:<br />

DATE <strong>OF</strong> AMOUNT <strong>OF</strong> AGGREGATE<br />

REDUCTION REDUCTION AMOUNT AVAILABLE<br />

_____________________ _______________________ _______________________<br />

_____________________ _______________________ _______________________<br />

_____________________ _______________________ _______________________<br />

_____________________ _______________________ _______________________<br />

_____________________ _______________________ _______________________<br />

In the event a drawing is paid under this Letter of Credit prior to the scheduled reduction, the amount of the<br />

scheduled reduction shall be reduced by the amount of such (previous) payment(s).<br />

In the event of an amendment (s) increasing or decreasing the credit value, the amount of the scheduled<br />

reduction shall be adjusted accordingly.<br />

Partial drawings are permitted hereunder.<br />

We hereby agree with you that documents drawn under and in compliance with the terms of this Letter of<br />

Credit shall be duly honored upon presentation as specified.<br />

This Letter of Credit shall be governed by the Uniform Customs and Practice for Documentary Credits, 1993<br />

Revision, International Chamber of Commerce Publication No. 500 (the “UCP”) and the provisions of the<br />

Uniform Commercial Code - Letters of Credit, title 8.5A of the Code of Virginia (1950), as amended (“Va.<br />

UCC-LOC”), except to the extent that the terms hereof are inconsistent with the provisions of the UCP or Va.<br />

UCC-LOC, including but not limited to Articles 13(b) and 17 of the UCP and Section 8.5A-108(b) of the Va.<br />

UCC-LOC, in which case the terms of this Letter of Credit shall govern.<br />

With respect to Article 13(b) of the UCP and Section 8.5A-108(b) of the Va. UCC-LOC, the Issuing Bank shall<br />

have a reasonable amount of time, not to exceed three (3) banking days following the date of its receipt of<br />

documents from the beneficiary, to examine the documents and determine whether to take up or refuse the<br />

documents and to inform the beneficiary accordingly.<br />

In the event of an Act of God, riot, civil commotion, insurrection, war or any other cause beyond our control<br />

that interrupts our business (collectively, an “Interruption Event”) and causes the place for presentation of<br />

this Letter of Credit to be closed for business on the last day for presentation, the expiry date of this Letter of<br />

Credit will be automatically extended without amendment to a date thirty (30) calendar days after the place<br />

for presentation reopens for business.<br />

This Letter of Credit is transferable, and we hereby consent to such transfer, but otherwise may not be<br />

amended, changed or modified without the express written consent of the beneficiary, the Issuing Bank and<br />

the Account Party.<br />

[BANK SIGNATURE]<br />

_____________________________________________________________________________________________<br />

STATE <strong>OF</strong>___________________________ CITY/COUNTY <strong>OF</strong>_____________________________, to wit:<br />

The foregoing instrument was acknowledged before me this _______day of __________________, 20_____,<br />

by________________________________________, Principal.<br />

My commission expires ________________________ Registration No.: ________________________________<br />

(SEAL)<br />

____________________________________________<br />

Notary Public<br />

#3768300 v1 036860.00002