Model Disclaimer Form - Prudential

Model Disclaimer Form - Prudential

Model Disclaimer Form - Prudential

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

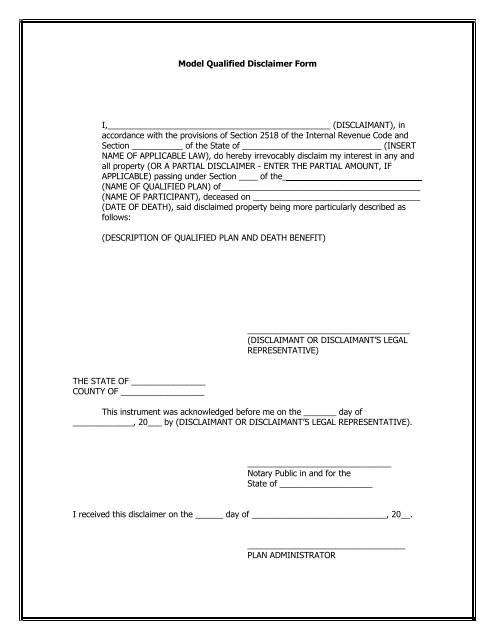

<strong>Model</strong> Qualified <strong>Disclaimer</strong> <strong>Form</strong><br />

I,________________________________________________ (DISCLAIMANT), in<br />

accordance with the provisions of Section 2518 of the Internal Revenue Code and<br />

Section ___________ of the State of ______________________________ (INSERT<br />

NAME OF APPLICABLE LAW), do hereby irrevocably disclaim my interest in any and<br />

all property (OR A PARTIAL DISCLAIMER - ENTER THE PARTIAL AMOUNT, IF<br />

APPLICABLE) passing under Section ____ of the_<br />

(NAME OF QUALIFIED PLAN) of___________________________________________<br />

(NAME OF PARTICIPANT), deceased on ____________________________________<br />

(DATE OF DEATH), said disclaimed property being more particularly described as<br />

follows:<br />

(DESCRIPTION OF QUALIFIED PLAN AND DEATH BENEFIT)<br />

___________________________________<br />

(DISCLAIMANT OR DISCLAIMANT’S LEGAL<br />

REPRESENTATIVE)<br />

THE STATE OF ________________<br />

COUNTY OF __________________<br />

This instrument was acknowledged before me on the _______ day of<br />

_____________, 20___ by (DISCLAIMANT OR DISCLAIMANT’S LEGAL REPRESENTATIVE).<br />

_______________________________<br />

Notary Public in and for the<br />

State of ____________________<br />

I received this disclaimer on the ______ day of _____________________________, 20__.<br />

__________________________________<br />

PLAN ADMINISTRATOR

Instructions for <strong>Model</strong> Qualified <strong>Disclaimer</strong> <strong>Form</strong><br />

Important Notice:<br />

Qualified disclaimers are governed by the Internal Revenue Code and the applicable state<br />

probate code. The model qualified disclaimer form satisfies the requirements of the Internal<br />

Revenue Code, but may or may not meet all the requirements of state law. Special rules<br />

may apply when the disclaimant is a nonresident alien. Therefore, we recommend the<br />

disclaimant seek competent legal advice to ensure that all of the state’s requirements have<br />

been met.<br />

General Requirements:<br />

The disclaimant is the person who would have received the disclaimed death benefit under<br />

the qualified plan if the disclaimer had not been made. This may be a beneficiary who was<br />

specifically designated by the participant, or a beneficiary determined under the plan’s<br />

default beneficiary provisions. However, the disclaimant is not necessarily the person making<br />

the disclaimer. The disclaimer may be signed by the disclaimant’s legal representative.<br />

The disclaimant must not have expressly or implicitly accepted the benefit before making the<br />

disclaimer. The beneficiary of a qualified plan may disclaim any interest, in whole or in part.<br />

The disclaimer is irrevocable once made.<br />

The disclaimer must be made and delivered to the plan administrator within nine (9) months<br />

of the later of the participant’s date of death or nine (9) months after the date on which the<br />

disclaimant attains twenty-one (21) years of age.<br />

Effective January 1, 2003, for a disclaimer to be valid for purposes of the Internal Revenue<br />

Code section 401(a)(9) minimum required distribution purposes, it must be delivered to the<br />

plan administrator by September 30 of the calendar year following the year of the<br />

participant’s death.<br />

Next Steps:<br />

Please return the completed qualified disclaimer with a notarized signature within ___ days<br />

to: _______________________________________________<br />

_______________________________________________<br />

_______________________________________________<br />

_______________________________________________