The Surging Cost of Basic Needs

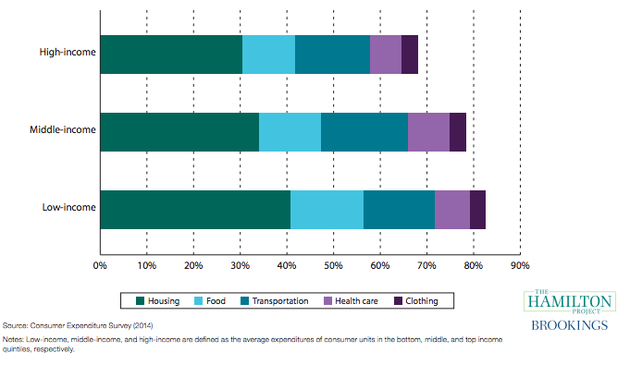

Low-income families spend more than 80 percent of their budget on things like housing, food, and health care—that’s a lot more than 30 years ago.

For low-income households, it’s no surprise that a large proportion of their spending goes to basic needs, such as housing and food, while high-income households have traditionally had more discretionary spending. But how do families cope when the cost of housing goes up, or the cost of transportation goes down? And how have their budgets adjusted in light of these changes in order to pay for everything?

A new report from The Hamilton Project of the Brookings Institution looks at how the composition of household spending across income levels has changed over the past 30 years. Analyzing data from the Bureau of Labor Statistics’ Consumer Expenditure Survey, the report found that budgets have indeed shifted—particularly for low-income families.*

The report found that low-income households are devoting a greater share of their budget to basic needs compared with 30 years ago. In fact, low-income and middle-income households (defined as the lowest and middle quintiles of the income distribution) now spend roughly 80 percent of their budget on housing, food, transportation, health care, and clothing. For low-income households, 40 percent of their budget went to housing—a 5.5 percent increase from 1984.

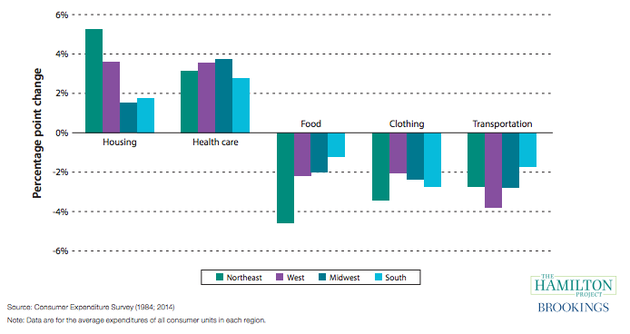

One particularly worrying aspect of this is that low-income and middle-income families might be cutting back spending on food in order to compensate for rising costs in housing and health care.

“The way we came to this question in the first place is that we found that the rate of food insecurity really spiked during the Great Recession, and it hasn't come back down,” says Diane Whitmore Schanzenbach, the director of The Hamilton Project and the lead author of the report. “That was surprising to us because prices for food have not particularly gone up. Why is it that more people are having trouble affording enough food to eat? That's why we dug into this question to see where the rest of the money is going.”

Over the past 30 years, low-income families have seen their real expenditures decline by 4.5 percent whereas middle- and high-income families have spent more. And yet, as low-income families spend less on basic needs in real terms, because their real earnings have barely budged, the proportion of their budgets devoted to basic needs has gone up. This not only means less discretionary spending for low-income families, but it raises questions about how these families are shifting their budgets in order to fit everything in.

“Something's got to give when housing goes up so much, and it makes me nervous when what gives might be food spending,” says Schanzenbach. “The low-income households have seen their real spending decline; more and more has to go to basic needs. What we want is all incomes to be growing, real growth, people having more money to spend, more disposable income and savings. But in fact, we've seen this disparity.”

* This article originally misattributed the Consumer Expenditure Survey to the U.S. Census Bureau. We regret the error.