Bail bond companies both weaken and profit from the criminal justice system — by keeping poor people in debt even after they've been cleared of charges — the American Civil Liberties Union said in a report released Thursday.

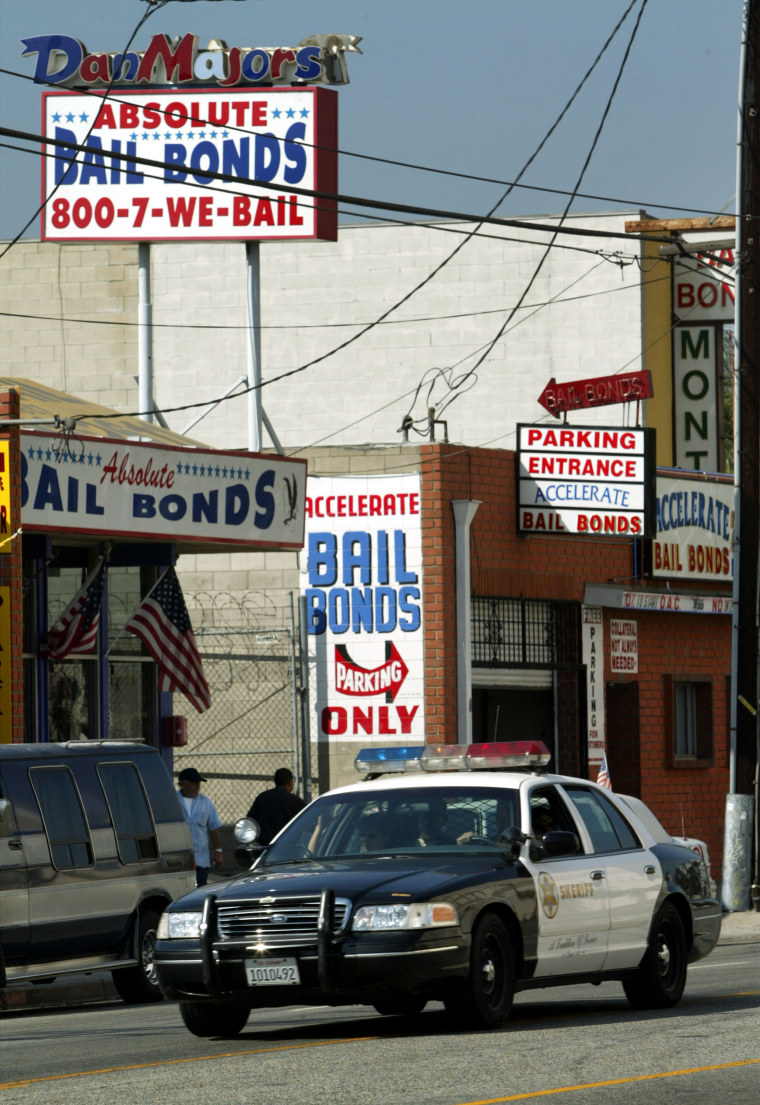

The $14 billion-a-year bail bond industry, underwritten by nine large insurance companies including some owned by multinational corporations, perpetuates a system in which people who can't afford bail remain in jail before trial. This leaves them with a choice between borrowing money or staying locked up, the ACLU said.

Those who remain incarcerated are less likely to win their court cases, researchers say. And those who borrow from bondsmen to buy their freedom often spend months or years paying it back.

That cycle of poverty and jail makes the for-profit bail system indefensible, according to Udi Ofer, director of the ACLU’s Campaign for Smart Justice, which assembled the report with the criminal justice reform group Color of Change.

Citing a statistic from the Prison Policy Initiative, Ofer said that more than 400,000 people are held in local jails while waiting for trial every day ─ far more than the 293,000 people in local jails that have actually been convicted of a crime.

Related: Cash Bail, a Centerpiece of the Justice System, Is Facing Its Undoing

The groups called for the elimination of the for-profit bail system, which would require a Herculean lobbying effort across dozens of states and counties. Some jurisdictions, including Washington D.C. and New Jersey, have already moved to eliminate their reliance on bail. Last month, a federal judge ruled that Harris County, Texas' bail system was unconstitutional.

"There is a fundamental moral problem with profit margins playing such a significant role in whether someone ends up being free or incarcerated," Ofer said. "Yet bail bond agents and the surety insurance companies behind them make those decisions on a daily basis, based on profit."

Representatives of the American Bail Coalition, which represents bail-bond companies, did not return messages seeking comment.

While cash bail is a cornerstone of the American criminal justice system, its use has increased dramatically in the past two decades, the report said. When people get stuck in jail for being unable to post bond, they are more likely to plead guilty to charges they didn't commit, just to return to their jobs and families.

The report, titled "Selling Off Our Freedom," is dotted with examples, culled from press reports, of bail gone awry: A Baltimore man who beat his 2008 criminal charge but is still paying off a bondsman; a Seattle man who was turned down by a bondsman and spent 41 days in jail; a San Francisco man whose case was dismissed but still owes a bond company $6,000.

It also repeats the tale of Sandra Bland, the 28-year-old Illinois woman arrested during a 2015 Texas traffic stop who was then found dead in her jail cell after failing to post bail.

Those stories, the report's authors wrote, are the real-world consequences of an industry that doesn't get enough regulatory attention and often lobbies lawmakers to block reforms.