“The stubbornly high and rising rents are keeping consumer prices elevated. The Federal Reserve therefore cannot yet relax on its monetary tightening policy. Mortgage rates could linger at around 6.5% for a few more months before heading below 6% by summer and maybe even 5.5% by the end of the year.

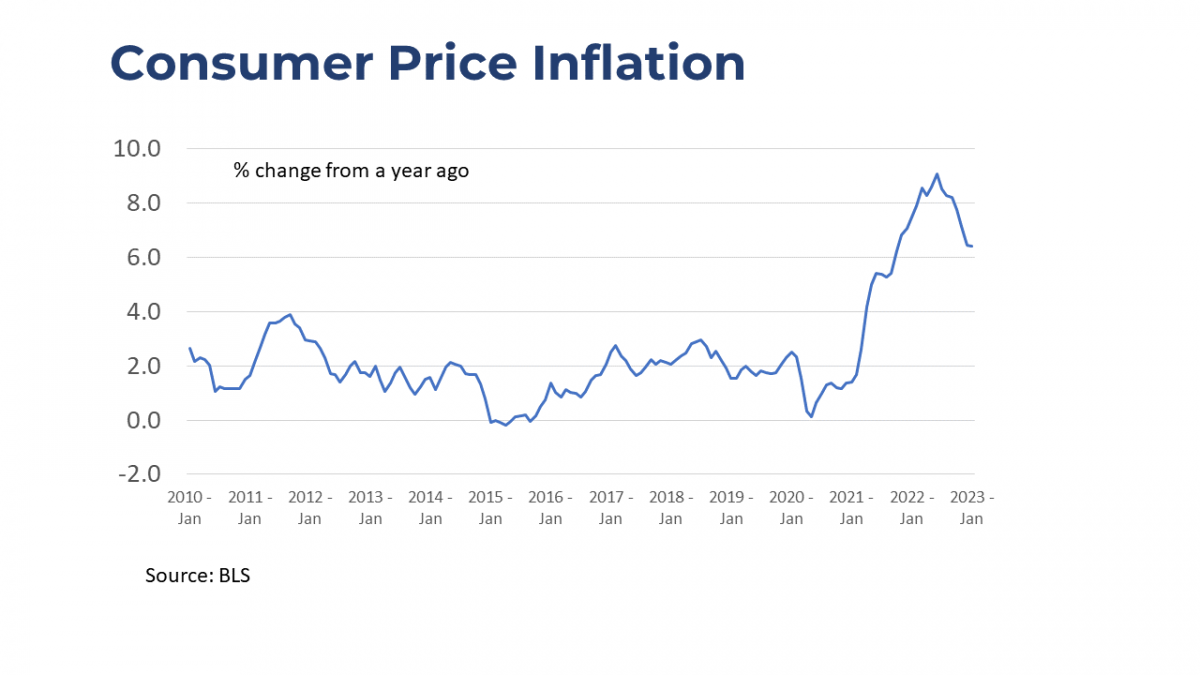

Specifically, in January, tenants of apartment and single-family homes paid 8.6% more in rents this year versus 12-months ago. Moreover, the monthly change was 0.7% or 8.8% on an annualized basis. That was a big contributor to the overall consumer price inflation running at 6.4% and well above the comfort level of 2% inflation. But rent relief is on the way. Apartment construction activity is at a 40-year high. As these new empty units steadily reach the market, rent growth will tame down. That will also pull back the overall consumer price inflation.

What is needed in addition to active apartment construction is the building of single-family homes. There are not many listings of homes for sale. As mortgage rates dip in future months, buyers will return. But without supply, another revival of multiple biddings could occur.”