June 29, 2023 - On Friday, June 30th, the last USD Panel LIBOR rates will be published. It is the end of an era – and the conclusion of a transition process that absorbed thousands of bankers and lawyers (including LSTA staff and members) for six years. Many things were challenging, a number of things went well and – perhaps surprising for some – more than a few contracts will remain on LIBOR in the coming months. This, FYI, is a feature, not a bug.

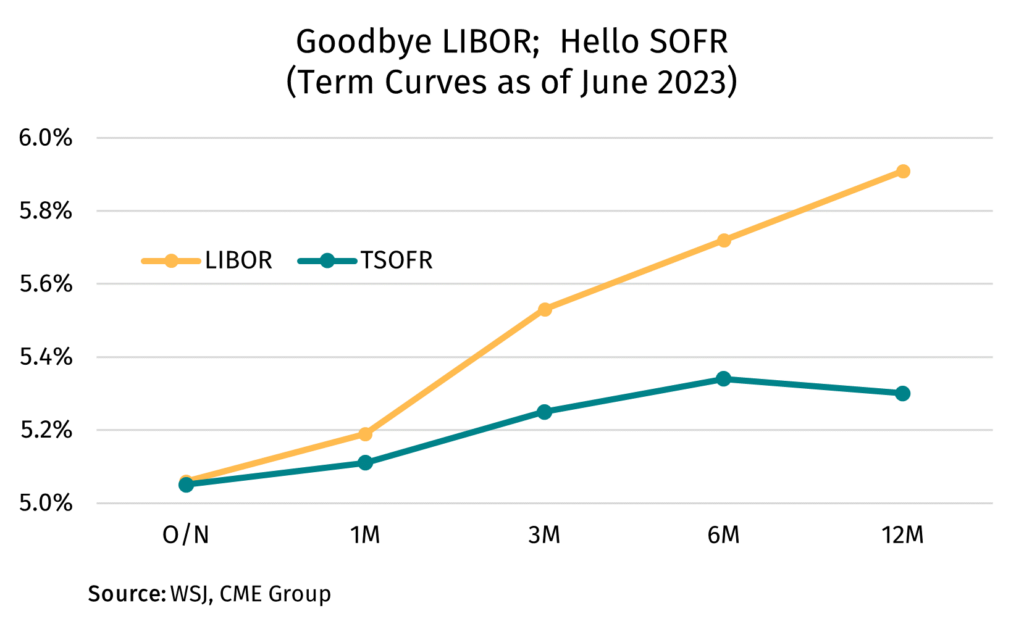

In looking back over the six years since the announcement of LIBOR cessation, the US loan and CLO markets have had to fundamentally reset their understanding of a reference rate. We shifted from a credit sensitive rate (LIBOR) that embeds a bank credit risk component (and is generally upward sloping) to a risk-free rate whose term structure is built from Daily Compounded SOFR futures trading (and hence can be upward, flat or downward sloping (see COW)). We have adapted to pricing over a risk-free rate (hence the ubiquitous CSA debate). And we were extraordinarily lucky to have access to Term SOFR; Daily Simple SOFR and Daily Compounded SOFR require the daily capture and calculation of interest rates in a way that is operationally challenging for a loan product that can partially prepay an interest contract at any time (sometimes without paying accrued interest) and trades without a set settlement time.

Most of the transition work is in the rearview mirror, but there are some ghosts of LIBOR that will linger a few months. First, we estimate that over 60% of outstanding institutional loans have been originated on or transitioned from LIBOR to SOFR. We base this on JPM’s estimates on Index loans pricing over SOFR (44% in May) plus the more recent portion of the $580 billion of loans that LevFin Insights has seen amending to fall back to SOFR this year (but likely is not yet referencing SOFR). Many of the remaining LIBOR loans will start their transition on July 1st, when the Financial Conduct Authority (FCA) is expected to announce that LIBOR is no longer representative. This will trigger all the remaining LIBOR loans whose fallback language includes a direct or indirect “non-representativeness” trigger. Importantly, triggering LIBOR transition language does not immediately shift a loan contract to SOFR. Instead, loans will run out their existing LIBOR interest periods and then shift to a SOFR reference rate at the next interest rate determination. With many loans typically resetting interest contracts at month-end, this means we should expect to see a number of loans lock in one remaining LIBOR contract before the reference rate shifts. The same logic applies to CLOs.

Finally, while panel LIBOR ceases on June 30, 2023, “synthetic” USD LIBOR will be with us until September 30, 2024. But don’t be fooled. Synthetic USD LIBOR simply is CME Term SOFR plus ISDA/ARRC Spread Adjustments. In other words, it’s just the rate to which most contracts are falling back anyway. Synthetic LIBOR exists because a number of non-US law governed USD LIBOR contracts had no fallback and no easy means to transition. The FCA is requiring the IBA to publish this SOFR-based “synthetic LIBOR” rate for a period of time to permit those tough legacy contracts to transition. A handful of US law governed BSL loans may use this construct, but few parties expect it to be widespread or long term.

And so, the SOFR era truly begins. Goodbye LIBOR.