LETTER OF CREDIT INTERNATIONAL TRADE

What Is A Letter Of Credit (aka Documentary Credit)?

To simply put it, a letter of a credit, also called documentary credit, is a payment method used in international sale contracts whereby payment is assured by banks.

After this stark definition, let’s try to explain this complicated but effective system a bit more in detail.

If you are an exporter and regularly sell internationally, you will know that the most important issue when dealing with buyers located abroad is being sure of getting paid.

In other articles we discussed other methods that are available for the parties, such as the open account, the bill of exchange, and the documentary bill. While each of these payment methods has its own perks and could be advantageous in certain situations, all of them fail to completely relieve the seller from the risk that the buyer defaults on his debt. Cash in advance could be an option, but it is unlikely to be accepted by the buyer since he is left with the risk that the seller does not send the merchandise.

The lifeblood of international trade

The letter of credit, also called documentary credit, is a widely-used payment method that is advantageous to both parties; it is the best assurance for the seller of being paid, and it does not oblige the buyer to anticipate cash. Since the letter of credit involves banks, the buyer may be even given credit.

The letter of credit is so widespread that it has been defined as the lifeblood of international trade.

It has been used for centuries, and its origins are to be found all over the world, from the ancient trade between Europe and China, to the colonial times.

As with trade terms, also the letter of credit has been standardized by the ICC (International Chamber of Commerce) starting from 1929 (even before the first publication of the Incoterms in 1936!). The current standardized rules are known as UCP 600 (Uniform Customs and Practice for Documentary Credits) and have been published in 2007, replacing the previous version UCP 500 (which is nevertheless still used in certain types of letter of credit). The UCP 600 is a set of 39 rules harmonizing the issuance and operation of a letter of credit. Just to give an idea of how widely used this form of payment is, the UCP 600 apply to 175 countries around the world, constituting some USD 1tn of trade per year.

Two principles underpinning the letter of credit

Before we dive into the definition of a letter of credit, there are two important principles that any international trader approaching a letter of credit should know.

First, the letter of credit is designed to assure certainty of payment to the seller. While it provides the buyer with credit, the letter of credit is skewed towards the seller.

What does this mean in practice? That in case of a dispute between the parties, the rules regarding the letter of credit, and most importantly, the courts, will not block payment through a letter of credit, unless something is wrong with its form or fraud has been proven.

Second, as we will see in a moment, central to a letter of credit is the role of banks. If one of the banks involved becomes insolvent, the system on which the letter of credit is built crumbles, leaving one party (most likely the buyer, as we just wrote) to bear the brunt of it. Therefore, the letter of credit works only if the parties choose reputable and reliable banks as their paymasters in the transaction.

Definition of letter of credit

In a letter of credit, the buyer agrees to pay the seller using a reliable paymaster, generally a bank in the seller’s country, who pays against presentation of documents that comply with the terms of the credit.

The first difference with other form of payment methods previously discussed is that, in a letter of credit, the buyer is the applicant and the seller is the beneficiary. The buyer has to start the process, not to accept it, as for example in the bill of lading.

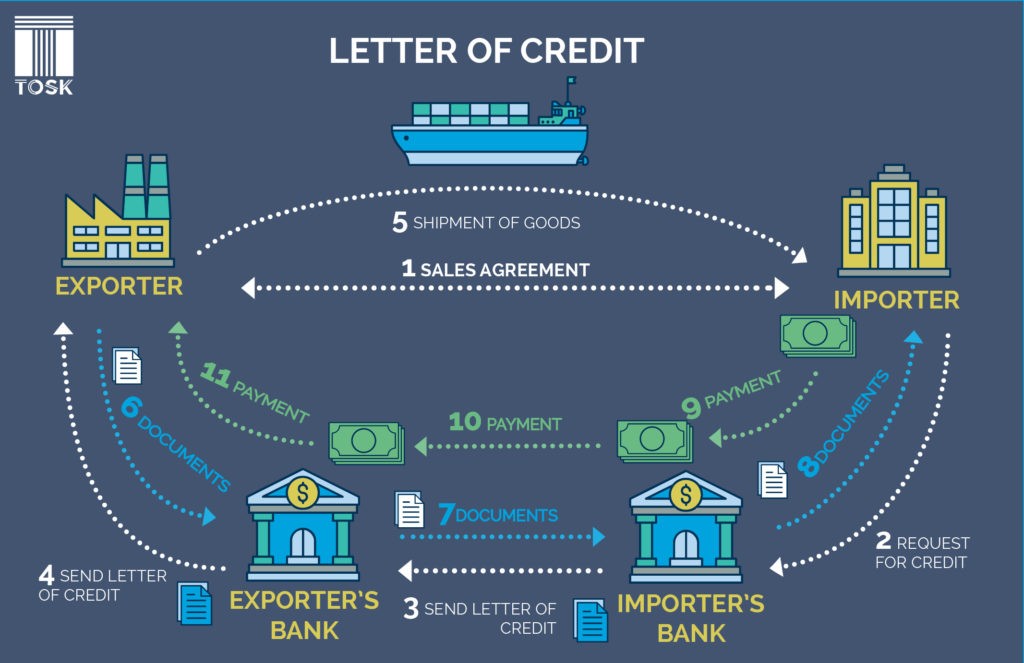

The buyer will open a letter of credit with his bank (the issuing bank) in his country; the issuing bank will then contact a bank located in the seller’s country (could be a local bank, an international bank, a branch of the issuing bank itself, depending on the issuing bank’s network, but most likely the seller’s bank), called the advising bank, to inform the seller that a letter of credit has been opened by the buyer. The advising bank will agree to pay the seller upon presentation of documents, usually transport documents, certificate of quality, etc.

The seller will ship the goods and obtain transport documents; upon presentation of such documents, if these comply with the form required, the advising bank will pay the seller.

The advising bank will then forward the same documents to the issuing bank and ask for refund.

The issuing bank will provide the buyer with the documents and collect the payment (or extend credit if such is the arrangement between the bank and the buyer).

If all of this sounds complicated, we have written an article describing the entire process here.

Advantages of the letter of credit

As you can see, the advantages for the seller are several: he is assured to get paid by a reputable bank, most likely his bank, located in his country; therefore, if the bank refuses to pay because the documents are not complete, he can sue the bank in his own country. Moreover, the seller will ship the goods only after the buyer has opened a letter of credit, i.e. the seller ships the goods being assured that he will be paid; the seller cashes in immediately after the goods have been shipped, i.e. he does not have to wait for the buyer to receive or approve the goods.

On the buyer’s side, one strong advantage is that he obtains both credit from the bank, and a payment method that assures his counterparty, all in once. This can be especially beneficial if the buyer has planned to resell the goods and does not have the liquidity yet to pay for the merchandise.

The letter of credit is not immune from disadvantages, to both parties: the seller must be extremely careful in how he arranges and presents the documents, whereas the buyer must realise that he will lose any control on the payment in the event of dispute with the seller.

Types of letter of credit

There are several types of letter of credit (each of them covered by our articles):

- Revocable letter of credit

- Irrevocable unconfirmed letter of credit

- Confirmed letter of credit

- Back-to-back letter of credit

- Transferable letter of credit

- Revolving letter of credit

- Red clause letter of credit

- Green clause letter of credit