Banking Law: Understanding Regulations And Principles Of Banking

Banking law refers to the collection of rules and principles that regulate the activities of financial institutions, notably banks. Banking Law is a subset of law that deals with many areas of the banking business, including lending, deposits, transactions, and regulatory compliance. Banking attorneys, often known as bank lawyers or banking and finance lawyers, are legal professionals who focus on advising and representing banks and financial organizations.

Banking law is important in today’s financial economy. It is a fundamental foundation for establishing the norms and standards that banks must follow. It comprises risk management principles, consumer protection, anti-money laundering procedures, and adherence to financial legislation established by regulatory organizations. Instability and a lack of faith in the banking system result in the absence of strong banking regulations that provide the required structure and protections for the financial industry.

One of the most important benefits of Banking Law is the protection it provides for both financial companies and their consumers. It sets explicit limits on permitted actions for banks, ensuring they operate within legal limitations. It helps to reduce legal risks and obligations. Banking Law provides rights and protections for consumers, such as privacy safeguards, fair lending procedures, and dispute resolution systems. It boosts trust in the financial system and encourages people and companies to do banking transactions.

Banking Law regulates a broad variety of banking-related activities. It involves supervising the loan and mortgage approval process, assuring compliance with anti-money laundering and Know-Your-Customer (KYC) rules, and establishing capital adequacy and liquidity criteria. It oversees bank mergers and acquisitions, as well as the issuing of securities and other financial instruments.

Banking attorneys and banking lawyers are significant tools to financial companies in negotiating the complexity of Banking Law. They give legal advice, ensure compliance with applicable rules, and, where required, defend their clients in legal actions. Their experience is critical in assisting banks in navigating the complex legal environment of the financial industry, eventually contributing to the banking sector’s overall health and prosperity.

Table of Contents

- What Is Banking Law?

- What Is The Importance Of Banking Law?

- What Is The Significance Of The Dodd-Frank Act In Banking Regulations?

- What Are The Principles Behind Basel III Regarding Banking Law?

- How Do Bankruptcy Laws Intersect With Banking Laws For Financial Institutions?

- What Are The Benefits Of Banking Law?

- What Does The Banking Law Regulate?

- What Are The Legal Implications Of Digital Banking Innovations In Regulatory Frameworks?

- How Are Customer Data Privacy Concerns Addressed Within Banking Law?

- How Do Banking Regulations Ensure Fair Lending Practices?

- How Does Banking Law Mitigate Risks Associated With Financial Derivatives Trading?

- How Do International Treaties Influence Cross-Border Banking Regulations?

- How Does Banking Law Address Issues Of Systemic Risk In The Financial Sector?

- What Is the Concept Of “Know Your Customer” (KYC) In Banking Law?

- What Safeguards Are In Place To Prevent Predatory Lending In Banking Law?

- What Are The Legal Parameters For Resolving Disputes Between Banks And Their Clients?

- What Is the Objective Of The Consumer Financial Protection Bureau In Banking Law?

- What Legal Provisions Ensure Transparency In Financial Disclosures According To Banking Law?

- Which Lawyer Manages Banking Law Related Cases?

What Is Banking Law?

Banking law, usually called financial law or banking regulation, refers to the rules, regulations, and legal frameworks that control the operations and activities of banks and financial organizations. Its primary goal is to guarantee the financial system’s stability, integrity, and transparency, as well as to protect the interests of depositors, borrowers, and investors. The broad area of law handles a variety of concerns, including the founding and licensing of banks, capital requirements, risk management, consumer protection, and compliance with anti-money laundering and counter-terrorism funding laws.

Banking law encompasses mergers and acquisitions within the banking industry, as well as the resolution of insolvent or systemically risky financial organizations. It is a dynamic and ever-changing field of legal practice that is inextricably linked to economic policies and the larger regulatory environment of a specific jurisdiction. Effective banking legislation is critical to sustaining public confidence in the financial system and promoting a stable and productive economy.

What Is The Importance Of Banking Law?

The importance of Banking Law is paramount in maintaining the stability and integrity of financial systems worldwide. It functions as a critical foundation for regulating the activities of banks and financial institutions, ensuring that they operate within ethical and legal constraints. One of its primary functions is safeguarding depositors’ interests, giving them confidence that their monies are safe and available when required. Banking Law provides severe rules for capital sufficiency and risk management, reducing the likelihood of financial crises and protecting the more extensive economy from the ramifications of a banking collapse.

Banking Law is critical in fostering fair and honest banking operations. It establishes criteria for lending, interest rates, and borrowers’ treatment to prevent financial institutions from engaging in predatory or exploitative activity. It promotes a more inclusive financial climate by making loans available to consumers and companies on affordable terms, hence boosting economic growth and development.

Banking Law addresses consumer protection issues, ensuring that financial goods and services are presented in a transparent, fair, and misleading way. It gives clients the information and rights they need to make sound financial choices. It introduces dispute resolution systems, enabling people to seek restitution in circumstances of unjust treatment or contractual problems.

Banking law is important in combatting financial crimes, including money laundering and terrorism funding. It requires banks to perform comprehensive due diligence processes and report questionable transactions to comply with anti-money laundering legislation. It helps national security operations and helps the worldwide battle against illegal money activity.

Banking Law provides the legal framework for the resolution of failing financial institutions during times of financial difficulty or economic downturns. It provides methods for orderly liquidation or rehabilitation, with the goal of minimizing disruptions to the financial system as a whole. The feature of the legislation is critical in avoiding systemic hazards and preserving general economic stability.

Why Does The Banking Law Exist?

Banking Law does exist because it is a key regulatory framework required to protect the stability and integrity of financial institutions. Its existence stems from the awareness that banking and financial operations are essential to any contemporary economy and, as such, need a defined legal framework to guarantee seamless functioning. The lack of such regulation leaves the financial sector open to risks and abuses that have far-reaching consequences for individuals, businesses, and the economy as a whole.

Banking Law safeguards the interests of all parties engaged in financial transactions. It establishes explicit expectations for ethical conduct, risk management, and compliance with legal norms by providing a set of rules and principles that regulate the behavior of banks and financial organizations. It contributes to developing a trusting and transparent atmosphere, which is necessary for the smooth operation of financial markets.

Another important reason for shaping a Banking Law is to protect depositors’ interests. The legislation ensures that people’s funds are safeguarded even if a financial institution fails by enforcing capital adequacy criteria and creating deposit insurance systems. The trust encourages individuals to put their money in banks, assuring the availability of capital for lending and investment, both of which are important drivers of economic development.

Banking Law concerns the possibility of market manipulation and unfair business activities in the financial industry. It establishes rules for responsible lending, interest rate control, and borrowers’ equitable treatment. It discourages financial institutions from engaging in predatory activity and helps to preserve a fair playing field for consumers and companies seeking loans.

Banking law is necessary for national and international security. It puts standards and methods to fight financial crimes, including money laundering and terrorism funding. The legislation supports the discovery and prevention of illegal financial operations by establishing severe compliance requirements, adding to larger efforts to safeguard public safety and security.

Banking Law establishes a framework for the resolution of financial organizations that face bankruptcy or systemic danger. It is critical in averting a domino effect when a big financial institution fails, perhaps leading to a larger economic disaster. The legislation provides methods for orderly resolution, which aids in mitigating the damage and protecting the financial system as a whole.

What Are The Key Regulatory Bodies Shaping Banking Law?

The key regulatory bodies shaping banking law are listed below.

- Office of the Comptroller of the Currency (OCC): The OCC is an autonomous agency under the United States Department of the Treasury. It manages and handles national banks and federal savings organizations to ensure their safe and sound operation.

- European Central Bank (ECB): The ECB is in charge of monetary policy and the euro stability inside the Eurozone. It collaborates with national regulatory bodies to oversee banks in member nations.

- Federal Reserve System (Fed): The Federal Reserve is the central banking system in the United States and is in charge of setting monetary policy, monitoring and policing banks, and preserving financial stability. It is crucial in defining the regulatory framework for the country’s financial institutions.

- Securities and Exchange Commission (SEC): The SEC, which mainly regulates securities in the United States, oversees specific sectors of the banking sector, significantly when banking and securities-related operations overlap.

- Prudential Regulation Authority (PRA): The PRA is part of the Bank of England and is in charge of overseeing and regulating banks, credit unions, insurers, and significant investment businesses in the United Kingdom.

- Financial Conduct Authority (FCA): The FCA, which is situated in the United Kingdom, regulates financial businesses to ensure they operate with integrity and in the best interests of customers.

- Federal Deposit Insurance Corporation (FDIC): The FDIC guarantees deposits at U.S. banks and thrifts while overseeing their safety and soundness. It is critical to sustaining public trust in the financial sector.

- European Banking Authority (EBA): It is an independent EU agency tasked with ensuring effective and uniform prudential regulation and supervision across the European banking sector.

- Basel Committee on Banking Supervision (BCBS): The international organization headquartered in Basel, Switzerland, establishes standards for banking supervision worldwide, including measures for risk management and capital adequacy.

- International Monetary Fund (IMF) and World Bank: The IMF and World Bank are not themselves regulatory bodies, but their policy suggestions and professional help to member countries significantly impact banking and financial rules.

How Do Anti-Money Laundering Regulations Impact Modern Banking Practices?

Anti-money laundering regulations impact modern banking practices by setting severe mechanisms to identify and prevent illegal financial transactions. The Financial Action Task Force (FATF) adopted worldwide rules for anti-money laundering (AML) activities in 1989, and these policies were first implemented globally. Many nations later adopted these rules, making them a critical component of the global financial architecture.

Banking lawyers play a critical role in implementing AML requirements as a requirement for all bank transactions. They make sure that financial institutions have strong compliance systems in place, such as client due diligence, regular monitoring, and reporting of unusual activities. These lawyers offer legal experience in developing and executing AML-compliant policies and processes, protecting the institution and its clients from possible legal consequences.

The effect of AML requirements on current banking activities is influenced by criminal law. Individuals or businesses engaged in money laundering face criminal prosecution if AML laws are violated. It acts as a disincentive while enforcing compliance in the financial industry. Criminal Law establishes the legal foundation for pursuing money laundering crimes, guaranteeing that individuals involved in illegal financial transactions suffer proper legal ramifications. It emphasizes the significance of AML legislation in safeguarding the integrity of the global financial system.

What Role Do Capital Adequacy Requirements Play In Banking Law?

The role that Capital Adequacy Requirements play in banking law is critical in guaranteeing financial institutions’ stability and resilience. These regulations specify how much capital banks must retain in proportion to their risk-weighted assets to cushion against future financial shocks and losses. Banking law tries to reduce the danger of bankruptcy and safeguard depositors’ interests by requiring a minimum amount of capital. Its primary purpose is to stop banks from taking too many risks since banks with more capital funds better handle sudden losses or economic downturns. It improves the overall soundness of individual banks and adds to the broader financial system’s stability.

Capital Adequacy standards provide a regulatory instrument for authorities to efficiently monitor and control the banking industry. Regulators examine banks’ financial health and risk profiles by establishing specified capital adequacy rules. It allows them to identify institutions operating with insufficient capital buffers and take remedial action to remedy the problem. It offers a means for distinguishing across banks with differing degrees of risk exposure, enabling customized regulatory monitoring based on their particular profiles.

Capital Adequacy regulations encourage careful and responsible financing. Banks are motivated to participate in lending operations that are more sustainable and less speculative when they are obliged to maintain a specific level of capital relative to their risk-weighted assets. It helps to avoid risky lending practices that result in a credit bubble or financial instability.

The public’s faith in the financial sector is maintained by these regulations. Knowing that banks must meet high capital adequacy rules gives depositors confidence that financially competent entities are keeping their monies. The trust encourages consumers and companies to continue utilizing financial services, which is critical for the economy’s successful operation.

What Is The Significance Of The Dodd-Frank Act In Banking Regulations?

The significance of The Dodd-Frank Act in banking regulations is profound, as it represents one of the most comprehensive and far-reaching overhauls of the U.S. financial regulatory framework since the Great Depression. The Dodd-Frank Act was enacted in 2010 in response to the 2007-2008 financial crisis. It aims to address systemic flaws in the financial system and avoid repeating the catastrophe. The formation of the Consumer Financial Protection Bureau (CFPB), entrusted with protecting consumers from harmful financial practices, was one of its primary provisions. The CFPB is a primary authority in ensuring fair and transparent procedures in sectors such as mortgages, credit cards, and other consumer financial goods due to the important move toward prioritizing consumer protection in the financial industry.

The Dodd-Frank Act included a slew of regulatory measures targeted at ensuring financial stability. It enforced stress tests on big financial institutions, severe capital adequacy standards, and improved risk management techniques. These measures were critical in strengthening banks’ capital levels and minimizing the possibility of bankruptcy during periods of economic crisis. The legislation created the Volcker Rule, which bans speculative trading by banks and limits their ability to participate in proprietary trading.

The Act addressed the problem of “Too Big to Fail” institutions, which were a major contributor to the 2008 financial crisis. It created the Orderly Liquidation Authority (OLA) as a vehicle for resolving big, systemically significant financial institutions in a timely and orderly manner without the need for taxpayer-funded bailouts. The clause attempted to limit the contagion effect that occurs if a big financial institution fails.

The Dodd-Frank Act boosted financial market openness. Derivative transactions must be cleared via central counterparties and traded on regulated exchanges or swap execution facilities. The increased transparency and supervision in a previously opaque and complicated sector of the financial markets.

What Are The Principles Behind Basel III Regarding Banking Law?

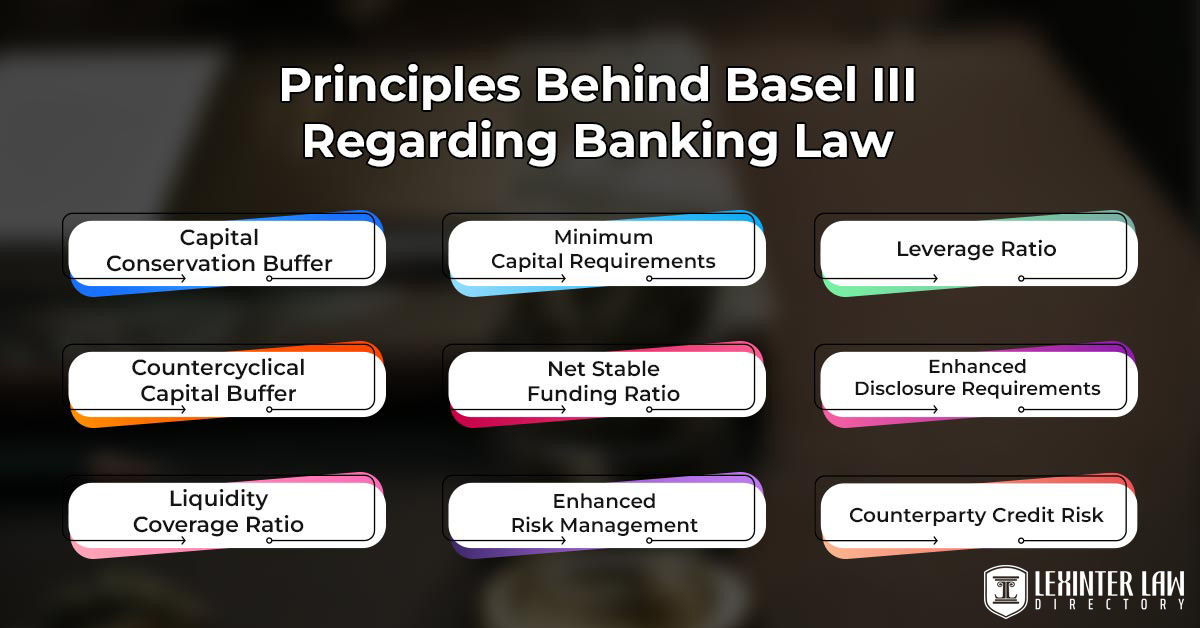

The principles behind Basel III Regarding Banking Law are listed below.

- Capital Conservation Buffer: Banks must maintain a Capital Conservation Buffer above and beyond the minimum capital requirements. Its buffer is an extra cushion to absorb losses during economic downturns, fostering a more resilient financial industry.

- Countercyclical Capital Buffer: Basel III adds a countercyclical capital buffer, which permits national regulators to force banks to build up more capital during excessive loan expansion. It contributes to the prevention of systemic hazards in the financial system.

- Liquidity Coverage Ratio (LCR): The LCR requires banks to have high-quality liquid assets to meet their short-term liquidity requirements. It guarantees that banks endure a time of difficulty without resorting to asset fire sales or depending significantly on borrowing.

- Minimum Capital Requirements: Basel III requires banks to maintain a minimum amount of capital in proportion to their risk-weighted assets. It guarantees that banks have a large enough cushion to withstand losses and stay solvent even in difficult economic times.

- Net Stable Funding Ratio (NSFR): The NSFR measures the long-term stability of a bank’s financing profile. It necessitates that banks maintain a stable financing structure that corresponds to the liquidity of their assets and off-balance-sheet exposures.

- Enhanced Risk Management and Governance: Basel III highlights the significance of strong risk management processes and effective governance structures inside banks. It involves steps to correctly identify, monitor, and manage risks.

- Leverage Ratio: Basel III provides a leverage ratio, which establishes a minimum amount of capital proportion to a bank’s total assets, regardless of risk weights. It protects against excessive leverage and aids in preventing systemic risk accumulation.

- Enhanced Disclosure Requirements: Basel III includes expanded disclosure standards to promote transparency and offer stakeholders a greater knowledge of a bank’s risk profile, capital adequacy, and liquidity position.

- Stress Testing: Banks are mandated to undertake periodic stress tests to examine their resistance to unfavorable economic situations. It contributes to banks having enough capital and liquidity to survive major shocks.

- Counterparty Credit Risk and Derivatives: Basel III tackles counterparty credit risk in derivatives transactions by imposing stricter capital requirements and improved risk management techniques.

The impact of the Basel III Principles on banks is significant. Banks must keep more capital and maintain more resilient liquidity positions, increasing their resilience to financial shocks and economic downturns. These regulations result in higher compliance costs for banks in the short run, but they help make the banking system more resilient to economic and financial shocks, which benefits savers and the economy as a whole.

How Do Bankruptcy Laws Intersect With Banking Laws For Financial Institutions?

Bankruptcy laws intersect with Banking Laws for Financial Institutions by providing a legal framework for the resolution of insolvent financial institutions. The connection between bankruptcy and banking rules becomes critical when a financial organization confronts serious financial difficulties or insolvency. A banking and finance lawyer is essential in navigating the difficult terrain. These specialist lawyers are well-versed in both the complexities of banking laws and the subtleties of bankruptcy law. They help financial institutions through the legal proceedings of bankruptcy, maintaining compliance with both sets of legislation while working toward a settlement that protects the interests of all parties.

Bankruptcy laws include procedures for the orderly liquidation or rehabilitation of financially distressed financial firms. For instance, the Dodd-Frank Act created the Orderly Liquidation Authority (OLA) in the US to aid in the managed resolution of systemically significant financial institutions. A banking and finance lawyer is invaluable in helping the institution and necessary authorities through the procedure and ensuring compliance with banking and bankruptcy legislation.

Bankruptcy laws affect claim priority in the case of a financial institution’s collapse. Creditors, such as depositors, bondholders, and other stakeholders, have varying rights and priorities during bankruptcy proceedings. A banking and finance lawyer is critical in advising on how these objectives are defined, as well as defending the financial institution’s and its stakeholders’ interests in bankruptcy procedures.

Bankruptcy laws impact the handling of the institution’s numerous financial instruments, such as complicated derivatives and structured products. A banking and finance lawyer specializing in both fields helps to negotiate the complexity of these financial instruments in the context of bankruptcy proceedings.

What Are The Benefits Of Banking Law?

The benefits of Banking Law are listed below.

- Financial Stability: Banking law sets regulatory structures that support financial institution stability. It establishes capital sufficiency and risk management regulations, lowering the possibility of bank failures and systemic financial catastrophes.

- Depositor Confidence: Banking law requires deposit insurance systems and capital adequacy criteria, which assure depositors that their monies are safe even if a bank fails. The trust encourages consumers and corporations to put their money in the hands of banks.

- Consumer Protection: Banking legislation contains safeguards to protect consumers’ interests. It governs lending, interest rates, and financial product disclosures, assuring client fairness and prohibiting abusive behavior by financial firms.

- Market Transparency: Banking legislation often requires financial organizations to provide information to stakeholders, investors, and the general public. The openness fosters confidence in the financial system and enables better-informed decision-making.

- Financial Distress Resolution: Banking law includes methods for resolving financially unstable institutions. It contributes to the reduction of disruptions to the larger financial system and the prevention of systemic threats.

- Risk Management: Banking legislation supports prudent lending practices and discourages excessive risk-taking by financial institutions via capital adequacy standards and other risk management measures. It aids in the prevention of credit bubbles and financial instability.

- Combating Financial Crimes: Anti-money laundering and counter-terrorism funding regulations are included in banking legislation. These restrictions aid in the detection and prevention of illegal financial transactions, therefore contributing to national and global security efforts.

- Prudent Financial Institution Regulation: Banking law offers a systematic method of regulating financial organizations by creating supervisory agencies and regulatory frameworks. It enables prompt intervention in situations of noncompliance or financial hardship.

- Incentives for Innovation and Development: Banking legislation promotes innovation and development in the financial industry while assuring stability. It creates potential for economic growth by providing a framework for new financial products and services.

- Efficient Payment Systems: Banking law oversees payment and settlement systems, providing the smooth and safe flow of money between banks, which is necessary for economies to operate.

- Global Coordination: International banking law standards, such as those established by the Basel Committee on Banking Supervision, encourage uniformity and coordination in banking rules across countries, eliminating regulatory arbitrage and improving global financial stability.

What Does The Banking Law Regulate?

The Banking Law Regulates the following aspects, as listed below.

- Money Laundering Prevention: Creating rules and safeguards to discourage and identify the criminal practice of disguising the source of illegally acquired funds.

- Crime Prevention: Implementing methods to discourage and battle different financial crimes such as fraud, embezzlement, and cybercrime.

- Prioritizing Lending for Economic and Social Priorities: Encouraging banks to direct their lending efforts toward industries and projects that are judged economically and socially beneficial.

- Fair Banking and Equal Opportunity: Ensuring that all persons, regardless of race, gender, or socioeconomic level, have access to banking services and chances for financial progress.

- Preventing Unfair Loans to Insiders: Taking steps to prohibit banks from making preferential loans to their officials and critical shareholders to avoid conflicts of interest.

- Terrorist Financing Prevention: Putting in place rules and processes to detect and report suspicious transactions that are used to finance terrorist operations.

- Fair Debt Collection Practices: Regulating the procedures and practices used by financial institutions to collect debts from borrowers, providing fairness and respect for customers.

- Banking Customer Confidentiality: Protecting the privacy and confidentiality of customer information and transactions, enabling people to conduct their banking activities in private.

- Consumer Transparency: Ensuring financial institutions give customers clear and intelligible information about their goods, services, and related expenses.

- Fair Credit Card Agreements: Enforcing openness and justice in credit card issuer-consumer agreements, ensuring that terms and conditions are explicit and reasonable.

- Customer Dispute Resolution: Making it possible for clients to raise and settle problems with their banks fairly and reasonably.

- Risk Reduction for Banking Customers: Taking steps, like capital balance standards and account protection, to reduce the risks for people and businesses who put their money in banks.

What Are The Legal Implications Of Digital Banking Innovations In Regulatory Frameworks?

The Legal Implications of Digital Banking Innovations in Regulatory Frameworks are extensive, necessitating a thorough study of current banking regulations. A banking lawyer specializing in the developing world of digital banking is essential in navigating these intricacies. They have the knowledge to comprehend how digital advances interact with existing banking legislation. It encompasses issues like data protection, cybersecurity, and adhering to anti-money laundering and Know-Your-Customer rules.

A banking lawyer advises organizations on the legal ramifications of implementing new digital banking technologies such as blockchain, artificial intelligence, and mobile banking applications. They aid in developing compliance methods that follow current regulations while supporting the growing standards of digital banking.

The need for updated regulations to resolve the unique challenges digital banking poses has a significant legal implication. It includes considerations for safeguarding client data in an online environment, ensuring secure transactions, and devising strategies for dealing with cybersecurity issues. Rules must be modified to account for decentralized financial technology, such as cryptocurrencies, which do not fit neatly into existing banking frameworks.

The rise of digital-only banks and fintech firms has led regulators to rethink license and supervisory regimes. Banking attorneys play an important role in guiding institutions through the licensing procedure for digital banking operations and maintaining regulatory compliance.

Cross-border digital transactions and activities raise jurisdictional issues. Banking attorneys assist financial organizations in understanding and navigating the legal challenges of operating in numerous countries, including international norms and treaties.

Digital banking advances have created concerns regarding user identification and authorization, as well as banks’ legal obligations in situations of illegal transactions or fraud. Banking lawyers aid in the development of processes and compliance mechanisms to resolve these problems.

How Are Customer Data Privacy Concerns Addressed Within Banking Law?

Customer Data Privacy Concerns are addressed in banking law by implementing various regulatory measures designed to protect the confidentiality and security of customer data. Banking laws require financial institutions to establish robust data protection policies and processes. These rules govern how customer data is collected, stored, processed, and shared, ensuring it is treated carefully and by applicable privacy laws.

Banking law requires the implementation of strong cybersecurity safeguards. It includes encryption, access restrictions, and regular security audits to safeguard client data against illegal access or breaches. Institutions must often swiftly notify such breaches and take remedial steps to reduce possible impact.

Client consent is an important issue addressed by banking legislation. Financial organizations must seek express agreement from clients before utilizing their data for reasons other than the primary transaction. It guarantees that people control how their information is used and shared.

Banking laws sometimes impose fines for non-compliance with data privacy standards. These fines are severe, and they act as a disincentive for organizations to prioritize and invest in strong data security procedures.

Transparency is another critical factor. Banking legislation compels institutions to give consumers clear and understandable privacy statements describing how their data are going to be handled and shared. The openness fosters trust and empowers consumers to make educated choices about their personal information.

Data retention policies are frequently mandated by banking law. Financial organizations must create criteria for how long client data must be kept and when it must be safely disposed of to reduce the risk of illegal access or abuse.

How Do Banking Regulations Ensure Fair Lending Practices?

Banking Regulations ensure Fair Lending Practices by enforcing rules and guidelines governing how financial institutions extend credit to borrowers. One of the most important methods is anti-discrimination legislation, which prohibits lenders from discriminating against borrowers based on their color, gender, ethnicity, religion, or other protected characteristics. These laws compel lenders to analyze loan applications using objective, non-discriminatory standards, ensuring that credit is granted fairly and equally to all qualified borrowers.

Banking laws mandate openness and disclosure. Lenders are required to give borrowers clear and full information about the terms and circumstances of the loans they issue. It contains information regarding the loan’s interest rates, fees, payback schedules, and any possible dangers. Regulations enable borrowers to make educated judgments about their financial obligations by guaranteeing access to accessible and comprehensible loan conditions.

Regulations require an evaluation of a borrower’s creditworthiness. Lenders must assess a borrower’s capacity to repay a loan based on income, job history, and credit history. Banks avoid lending to persons who are at high risk of default by undertaking rigorous and impartial evaluations while avoiding the arbitrary rejection of creditworthy candidates.

Banking regulations mandate lenders to provide loans to underprivileged or underrepresented groups. It fosters financial inclusion and guarantees that critical financial services are available to all sectors of society. Lenders are obligated to direct a part of their lending activity to regions or populations that have traditionally suffered credit restrictions.

Regulatory agencies examine and audit financial institutions regularly to verify compliance with fair lending regulations. These audits determine if lenders are following existing rules and not participating in discriminatory lending practices. Penalties, fines, and other regulatory measures are imposed for noncompliance.

How Does Banking Law Mitigate Risks Associated With Financial Derivatives Trading?

Banking Law mitigates risks associated with financial derivatives trading by establishing regulatory frameworks and norms that control the activity of financial institutions that participate in derivative transactions. It is accomplished in part through the establishment of capital adequacy requirements. These regulations compel banks and other financial institutions to keep a certain amount of capital in proportion to their total risk-weighted assets. It guarantees that businesses have a cushion to withstand any possible losses from derivative trading activity. Banking Law protects against undue leverage and supports financial system stability by enforcing capital adequacy criteria.

Banking Law places strict reporting and transparency obligations on financial organizations that trade derivatives. It involves providing clear and accurate information about their derivative holdings, risk exposures, and valuation processes. Regulators and market players acquire insight into the degree of risk a financial institution faces via its derivative activity. The openness helps analyze the institution’s overall soundness and allows regulators to respond quickly if excessive risk-taking is detected.

Another important way that Banking Law mitigates risks in derivatives trading is by establishing standards for counterparty risk management. It includes requiring thorough due diligence in the selection and monitoring of counterparties, as well as implementing strong collateral and margining policies. These steps are intended to limit the possibility of counterparty failure, hence decreasing possible damages in the event of a counterparty’s bankruptcy. Banking Law contributes to the reduction of systemic risks connected with derivative transactions by requiring effective counterparty risk management.

Banking Law ensures financial institutions have appropriate internal risk management practices. It entails mandating institutions to implement complete risk management frameworks, which include policies, processes, and systems for identifying, measuring, monitoring, and controlling derivative trading risks. Regulators ensure these risk management measures are followed via frequent audits and assessments. The proactive strategy contributes to the general stability of the financial system by preventing the accumulation of excessive risk inside financial institutions.

How Do International Treaties Influence Cross-Border Banking Regulations?

International Treaties influence Cross-Border Banking Regulations by establishing a framework for financial supervision cooperation and coordination across various countries. International law is critical in creating the regulatory environment by setting standard norms and principles that regulate cross-border banking activity. These accords make it easier for regulatory bodies to share information and best practices, resulting in a more unified approach to supervision and regulation. They provide methods for resolving disputes and assuring adherence to agreed-upon standards, which is critical in a global financial system of interconnectivity and interdependence.

International Treaties often result in establishing supervisory organizations or forums where regulators from different countries gather and interact. These entities act as discussion forums for developing concerns, as well as for exchanging views on regulatory measures and coordinating policy responses to prospective dangers. Organizations such as the Financial Stability Board (FSB) and the Basel Committee on Banking Supervision (BCBS), for example, serve as platforms for international collaboration and establishing uniform regulatory standards. International Law promotes a multilateral approach to cross-border banking regulation via various venues, ensuring that regulatory methods are universally uniform and favorable to financial stability.

International treaties result in the development of mutual recognition agreements between nations. These agreements recognize that one jurisdiction’s regulatory structure fulfills the treaty’s criteria and obligations. Mutual recognition makes it easier for financial institutions to operate across borders since they depend on their home country’s regulatory framework while doing business in other jurisdictions. It enhances efficiency and lowers entrance barriers, increasing international financial activity while ensuring proper regulatory standards are maintained.

International Treaties impact the establishment of legal frameworks for resolving cross-border financial crises. They establish rules for resolving failing financial institutions with a global presence, ensuring that the process is coordinated, and orderly, and reduces systemic risks. Mechanisms for exchanging information, coordinating supervisory actions, and easing the movement of assets and liabilities across borders are all included. International Law, by providing these frameworks, serves to limit the spillover effects of a financial crisis from one country to another.

How Does Banking Law Address Issues Of Systemic Risk In The Financial Sector?

Banking Law addresses issues of Systemic Risk in the Financial Sector by establishing a variety of procedures aimed at detecting, monitoring, and managing risks that have the potential to disrupt the whole financial system. One critical part is the establishment of prudential rules, which establish criteria for financial institutions’ capital adequacy, liquidity, and risk management methods. These requirements guarantee that banks have an adequate capital buffer for their risk exposure, lowering the possibility of bankruptcy during economic downturns. Banking Law is a buffer against excessive risk-taking and fosters financial sector stability by enforcing prudential rules.

Banking Law requires stress testing and scenario analysis for financial organizations. Banks are subjected to simulated bad economic situations to measure their resilience and capacity to absorb significant shocks. These drills assist regulators and institutions in identifying weaknesses and taking preventative actions to enhance their financial standing. Banking Law tackles possible sources of systemic risk and ensures that institutions are better prepared for unfavorable situations by undertaking stress testing.

Banking Law highlights the significance of appropriate risk management strategies in financial organizations. It involves the need for strong internal control systems, thorough risk assessment procedures, and proper governance structures. Banking Law tries to reduce the chance of excessive risk-taking that leads to systemic instability by creating a culture of risk awareness and responsible decision-making. It requires the creation of contingency plans and resolution mechanisms for dealing with the probable breakdown of systemically significant institutions. It guarantees that measures are in place to handle its resolution in a timely and orderly way, minimizing the effect on the wider financial system if a big institution experiences trouble.

The development of regulatory authorities charged with regulating and supervising financial institutions is another key component in mitigating systemic risk. These authorities play an important role in ensuring that prudential requirements are followed, and regular reviews of a bank’s risk profile and financial soundness are performed. Banking Law assists in identifying and correcting problems before they become systemic dangers by establishing independent monitoring. It enables early action in circumstances when a financial institution’s risk-taking conduct threatens the stability of the larger financial system.

What Is the Concept Of “Know Your Customer” (KYC) In Banking Law?

The concept of “Know Your Customer” (KYC) in Banking Law refers to the process of verifying and understanding the identity and background of consumers that financial institutions are required to conduct. The procedure is a critical component of the banking sector’s anti-money laundering (AML) and counter-terrorism financing (CTF) activities. KYC procedures have been implemented to guarantee that banks and other financial institutions know their client’s financial activity, risk profiles, and possible exposure to unlawful or criminal activities.

KYC’s primary goal is to reduce the risks connected with financial crimes, including money laundering, fraud, and terrorism funding. Banks develop trust and confidence in the integrity of their client base by adequately identifying and validating the identification of their consumers. Obtaining different types of identification, such as government-issued identity papers, proof of residence, and, in certain situations, supplementary paperwork for business organizations, is part of the procedure. Financial institutions use additional due diligence processes for high-risk consumers, such as politically exposed individuals or clients from countries with significant AML/CTF threats.

KYC is a continual process that requires regular oversight of consumer transactions and activities. It allows banks to identify any unexpected or suspicious conduct that suggests financial malfeasance. Large or frequent transactions, for example, that differ from a customer’s regular behavior warrant additional examination. Financial institutions guarantee that their knowledge of a customer’s risk profile stays correct and up to date by being watchful and performing frequent evaluations.

KYC compliance is a statutory requirement and an important component of a bank’s risk management system. Failure to establish appropriate KYC processes has severe legal and financial ramifications for the organization. International standards and guidelines, which are often established by organizations such as the Financial Action Task Force (FATF), play an important role in influencing KYC procedures and expectations across countries.

What Safeguards Are In Place To Prevent Predatory Lending In Banking Law?

The safeguards in place to prevent Predatory Lending in Banking Law are intended to protect consumers from unjust and deceptive lending practices. One important aspect is the need for lenders to offer borrowers clear and transparent information. It provides specific information regarding the loan’s terms and circumstances, such as interest rates, fees, and repayment schedules. Banking Law helps borrowers make educated choices about their borrowing alternatives by ensuring they have access to comprehensive and readily understandable information. It reduces the possibility of falling victim to predatory lending practices.

Another important safeguard is the implementation of usury regulations, which restrict the maximum interest rates that lenders charge. These rules differ by jurisdiction, but they always serve as a basic safeguard against high and exploitative interest rates. Banking Law works to stop lenders from exploiting gullible customers by levying high fees and interest in enforcing interest rate limitations.

Banking Law requires fair and non-discriminatory lending procedures. It implies that lenders are not allowed to base loan choices on race, ethnicity, gender, or other protected traits. Banking Law strives to guarantee that loans are granted based on a borrower’s creditworthiness and capacity to repay, rather than discriminatory or exploitative factors, by implementing anti-discrimination regulations.

Lenders are often required by legislation to analyze a borrower’s capacity to repay a loan before giving credit. It entails doing a complete assessment of the borrower’s financial condition, including income, spending, and previous debt commitments. Lenders make more responsible lending choices and avoid placing borrowers in circumstances where they are likely to fail by completing such evaluations.

Consumer protection laws play a key role in combating unscrupulous lending. Borrowers who have been exposed to unfair or fraudulent loan practices have legal recourse under these statutes. Borrowers pursue remedies such as rescinding the loan, collecting damages, or getting other types of relief under these provisions.

Regulatory agencies monitor and enforce adherence to these precautions. They examine and audit financial institutions to verify that they are following the appropriate rules and regulations regulating lending operations. Regulatory authorities have the power to impose enforcement measures, such as fines, penalties, and license revocation, in situations of non-compliance.

What Are The Legal Parameters For Resolving Disputes Between Banks And Their Clients?

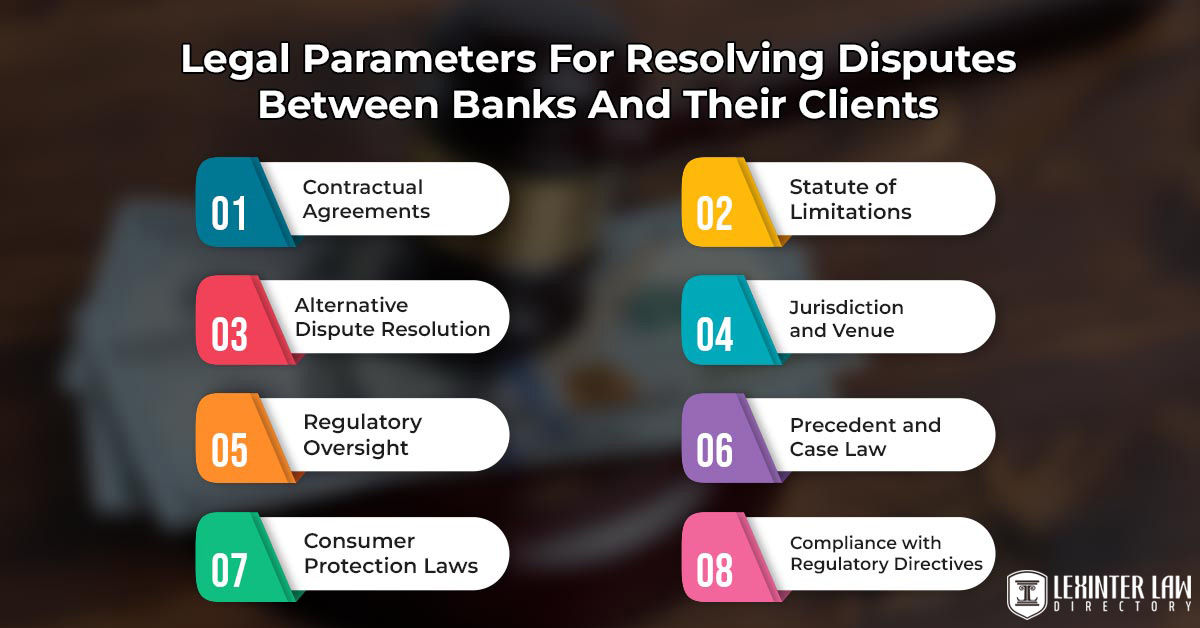

The Legal Parameters for resolving disputes between Banks and their Clients are listed below.

- Contractual Agreements: The terms and conditions of the Contractual Agreement between the bank and its customer are often the basis for settling conflicts. These agreements spell forth each party’s rights, duties, and obligations. They contain measures for resolving conflicts, such as processes for mediation, arbitration, or litigation.

- Alternative Dispute Resolution (ADR): Many banking contracts have language requiring the parties to try alternative dispute resolution procedures before resorting to formal litigation. ADR procedures, such as mediation or arbitration, allow for a more informal and typically faster resolution of disagreements. Mediation is a neutral third party assisting the parties in reaching an amicable solution, while arbitration entails a neutral arbiter making a binding judgment based on facts submitted by both parties.

- Regulatory Oversight: Regulatory agencies, such as banking commissions or financial regulatory organizations, often have mechanisms in place for resolving complaints between banks and their customers. These methods need the regulator’s engagement in the settlement process and offer customers extra safeguards.

- Consumer Protection Laws: Various consumer protection laws and regulations control bank-client transactions. These laws give customers rights and remedies if the bank engages in unfair or misleading activities. They provide customers the opportunity to raise grievances and seek remedies.

- Statute of Limitations: The time when a customer files a legal action against a bank is governed by law. It is referred to as the statute of limitations. All parties must be aware of these limits since failure to commence legal action within the time period specified results in the loss of legal remedies.

- Jurisdiction and Venue: Legal action is required to address conflicts that are unable to be settled via dialogue. The selection of jurisdiction (the place where the matter is heard) and venue (the particular court or tribunal) is crucial in the settlement process. It is established by the terms of the contract or by relevant legislation.

- Precedent and Case Law: Previous legal judgments, known as legal precedent or case law, have a substantial influence on the result of a dispute. Prior judgments are often referred to by courts when deciding the legal principles that apply to a particular case.

- Compliance with Regulatory Directives: Banks must follow regulatory instructions and rules. Failure to do so results in legal penalties. Specific criteria for conflict resolution processes are included in these directives.

How Does Banking Law Regulate Electronic Fund Transfers And Online Banking Security?

Banking Law regulates Electronic Fund Transfers and Online Banking Security by developing a comprehensive framework that oversees electronic payment systems and protects the security of online financial operations. The implementation of the Electronic Fund Transfer Act (EFTA) and its accompanying Regulation E is a critical issue. These rules define the rights, liabilities, and obligations of customers and financial institutions involved in electronic money transfers, including error resolution methods, transparency standards, and liability restrictions. Banking Law offers a clear structure that fosters openness, justice, and accountability in electronic payment systems by outlining the legal basis for electronic financial transfers.

Banking Law requires that adequate security measures be used for online banking services. It includes multi-factor authentication standards, encryption systems, and other technology meant to protect the confidentiality and integrity of consumer information. Financial organizations must adopt security safeguards to prevent unauthorized access, fraud, and data breaches. Regulatory bodies publish recommendations and best practices to help banks maintain a high degree of security in their online banking operations.

Banking Law often mandates financial institutions to develop and implement incident response strategies for dealing with cybersecurity breaches or security events. These plans detail the measures that a bank must follow in the case of a security issue, such as notifying impacted parties, conducting an investigation, and remediating the situation. Banking Law ensures that financial institutions are prepared to react effectively to security risks in a timely and orderly way by requiring the establishment of incident response plans.

Regulatory bodies conduct checks and audits to determine a bank’s compliance with security regulations. They assess the efficacy of the bank’s security measures, policies, and processes to verify that they meet regulatory requirements. The monitoring assists in holding financial institutions responsible for maintaining the highest possible security requirements in their electronic money transfer and online banking activities.

The Payment Card Industry Data Security Standard (PCI DSS) is often used in Banking Law as a widely recognized security standard for securing payment card data. Financial institutions that process payment card transactions are often obliged to comply with PCI DSS criteria, which encompass a variety of data security topics such as encryption, access restrictions, and regular security testing.

What Is the Objective Of The Consumer Financial Protection Bureau In Banking Law?

The objective of the Consumer Financial Protection Bureau (CFPB) in Banking Law is to protect and empower consumers in the financial industry. The CFPB was established in 2010 as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act to ensure that consumers have access to fair, transparent, and competitive financial goods and services. It is an independent agency whose primary mission is to safeguard customers from fraudulent, unfair, or abusive financial institution activities.

A significant objective of the CFPB is to encourage openness and clarity in financial transactions. It is accomplished by forcing financial institutions to provide explicit and intelligible disclosures on the terms and circumstances of different financial instruments, such as mortgages, credit cards, and loans. The CFPB seeks to empower consumers to make wise financial decisions by ensuring they have access to clear information. It eventually results in a more equitable and effective financial market.

The CFPB strives to prohibit financial institutions from engaging in misleading or exploitative activities. It provides rules and regulations that control financial institutions’ behavior, emphasizing customer protection. The CFPB, for example, makes rules governing mortgage lending, debt collection, payday lending, and other consumer financial goods and services. The CFPB aims to provide a fair playing field for consumers and financial institutions by establishing clear rules and enforcing compliance.

The CFPB actively participates in consumer education and advocacy. It offers resources, tools, and instructional materials to assist customers in understanding their financial rights and obligations. It contains advice on budgeting, saving, credit management, and navigating different financial products. The CFPB helps consumers make informed financial choices and protect themselves from traps via its educational activities.

The CFPB examines consumer complaints and prosecutes financial firms that engage in illegal activities. It has the jurisdiction to levy penalties and fines on organizations that violate consumer protection legislation. The enforcement authority acts as a disincentive to unethical activity in the financial business.

What Legal Provisions Ensure Transparency In Financial Disclosures According To Banking Law?

The Legal Provisions that ensure transparency in financial disclosures according to Banking Law are intended to promote openness, clarity, and responsibility in the financial sector. One essential rule requires financial organizations to follow recognized accounting standards. These standards, such as the Generally Accepted Accounting Principles (GAAP) in the United States, offer a uniform framework for compiling and presenting financial statements. Banks guarantee that their financial information is consistently disclosed by adhering to these widely recognized norms, promoting comparability and openness for stakeholders.

Financial institutions are subject to special disclosure obligations imposed by regulatory agencies. These regulations govern the content and structure of financial statements and reports banks must give to regulators, shareholders, and the general public. It contains information about the institution’s financial performance, risk exposures, capital sufficiency, and other essential elements of its operations. Banking Law guarantees stakeholders access to accurate and relevant information about a bank’s financial health and performance by enforcing extensive and standardized disclosures.

Banking Law often requires releasing annual reports and financial statements, which are made public. These records give a thorough examination of the bank’s financial status, operations, and performance during a specified time period. They comprise audited financial statements, management discussions and assessments, and other pertinent disclosures. The availability of these reports increases openness and helps interested parties to evaluate the bank’s financial situation and make educated judgments.

Regulatory authorities mandate banks to publish certain risk management, capital adequacy, and liquidity information. For example, the Basel Committee on Banking Supervision’s (BCBS) Basel III framework establishes comprehensive standards for the disclosure of capital and liquidity ratios, as well as other critical indicators of a bank’s financial health. These disclosures are critical for evaluating financial institutions’ resilience and soundness.

Banking Law often requires the notification of related-party transactions and any conflicts of interest. It guarantees that transactions between the bank and parties with whom it has a close connection, such as affiliates or senior management staff, are recorded publicly. Banking Law, by mandating such disclosures, aims to avoid situations in which personal interests collide with the best interests of the bank and its stakeholders.

How Do Insider Trading Laws Relate To The Banking Industry?

Insider trading laws relate to the banking industry by making it illegal for employees to utilize non-public, material knowledge inappropriately. These standards apply to the banking sector and other firms to maintain the integrity and fairness of financial markets. Insider laws are particularly significant in the banking industry because of the sensitive nature of the information maintained by financial institutions. Employees, executives, and directors of banks often have access to confidential information that, if used for personal gain or the benefit of others, has the potential to change market conditions and harm investors.

The difference between public and non-public information is critical in determining how insider trading prohibitions apply to the banking industry. Trading securities based on substantial, non-public information about the bank or other companies is strictly prohibited for banking professionals. It includes earnings announcements, mergers and acquisitions, significant regulatory actions, and other events that impact the bank’s stock price. Compliance with these standards contributes to market fairness by preventing industry players from gaining an unfair advantage over other market participants.

Banking professionals must adhere to stringent transparency and reporting requirements. It ensures that any large transactions involving the securities of their own bank or the securities of other businesses in which the bank has a substantial position are appropriately documented and declared to regulatory authorities. Trading from inside guidelines improves transparency and accountability in the banking industry by demanding timely and accurate reports.

The banking sector is subject to heightened regulatory supervision and scrutiny regarding insider trading. Regulatory organizations, such as the Securities and Exchange Commission (SEC) in the United States, constantly monitor banks and their employees to ensure that insider trading restrictions are followed. Banks must have internal policies and procedures in place to prevent and detect insider trading inside their organizations. Such processes include employee training, internal controls, and monitoring systems.

Insider trading laws apply to bank workers and workers, as well as to their family members and close associates. It is done to prevent individuals from breaching the law by disclosing non-public information to others who then conduct transactions on their behalf.

How Does Banking Law Balance The Interests Of Creditors And Debtors In Loan Recovery Processes?

Banking Law balances the interests of Creditors and Debtors in Loan Recovery Processes by providing a structured legal framework outlining each party’s rights, duties, and obligations. One critical issue is the creation of clear and transparent credit agreements. These agreements include the loan’s terms and circumstances, such as repayment schedules, interest rates, and any collateral the debtor offers. Banking Law sets a framework for fair and predictable loan recovery procedures by ensuring that loan agreements are well-defined and fully understood.

Banking Law often mandates financial institutions to participate in good faith talks and seek out solutions with debtors who are experiencing financial problems. Loan modifications, forbearance agreements, and restructuring plans are examples of such choices. Banking Law strives to encourage agreements that allow debtors to satisfy their commitments while addressing the interests of creditors by fostering open communication and discussion.

Banking Law offers legal remedies for both creditors and debtors in the case of default. It includes the creditor’s right to initiate legal action to recover the outstanding debt, obtain a judgment, and, if applicable, seize collateral. Legal safeguards are in place to protect borrowers from abusive or unduly aggressive debt collection operations. These safeguards include rules for equitable debt collection techniques and restrictions on specific collection actions.

Banking Law often requires creditors to give debtors clear and accurate information about their rights and choices in the case of default. It contains information on the repercussions of default, prospective legal proceedings, and any settlement possibilities. Banking Law aims to level the playing field between creditors and borrowers by informing debtors about their rights and possible routes for remedy.

Banking Law mandates a fair and transparent procedure in situations of foreclosure or repossession. Specific notification requirements, dates, and processes must be followed before a creditor takes possession of the collateral. These precautions protect debtors’ rights and guarantee that the recovery process is legitimate and fair.

Which Lawyer Manages Banking Law Related Cases?

The lawyer who manages banking-related cases is a banking attorney. These legal professionals specialize in the intricate field of Banking Law, which encompasses a wide range of regulations, transactions, and disputes related to financial institutions. Banking lawyers possess expertise in regulatory compliance, mergers and acquisitions, loan documentation, securities offerings, and other matters specific to the banking industry. They work with banks, credit unions, financial institutions, and even regulatory agencies to navigate the legal complexities that arise within the financial sector. A Banking Lawyer is equipped to handle a variety of cases, including those involving lending practices, regulatory compliance, mergers and acquisitions, and more. They play a crucial role in advising and representing clients involved in banking-related legal matters, ensuring that they adhere to the relevant laws and regulations governing the financial industry.

Does Banking Law Protect Consumers From Lending Scams?

Yes, the Banking Law does protect consumers from Lending Scams. These regulations are intended to provide a framework that assures fair and transparent banking activities. Regulations that compel financial institutions to follow thorough due diligence processes before making loans are one of the key ways that customers are protected against lending fraud. It involves checking borrowers’ creditworthiness and determining their capacity to repay the loan. Some regulations require lenders to publish all loan terms and circumstances, including interest rates, fees, and repayment schedules, in a plain and intelligible way. Openness is essential for avoiding misleading techniques that lead to financing fraud.

Banking Law enforces laws that ban predatory lending. These tactics include imposing unfair or abusive loan conditions on borrowers and frequently taking advantage of their lack of financial awareness or desperate circumstances. The legislation helps to reduce such exploitative activity by establishing clear limits on appropriate lending practices. There are procedures to fight usury, which is the practice of charging exorbitant interest rates on loans. Usury laws help to limit interest rates, shielding borrowers from potentially devastating financial agreements.

The Banking Law gives regulatory authorities the authority to supervise financial firms and enforce compliance with these consumer protection provisions. These regulatory authorities have the jurisdiction to investigate complaints, perform audits, and levy fines on banks or lenders that violate set standards. The inspection contributes to the integrity of the loan process and acts as a disincentive to fraudulent activity.

Banking Law offers channels for remedy when customers fall victim to loan fraud notwithstanding these safeguards. It includes taking legal action against the offender, as well as reporting fraudulent activity to the proper regulatory authorities. Financial institutions must often have systems, such as dispute resolution processes, to handle customer concerns and remediate any possible damage caused by scammers.

Are Customer Data Privacy Concerns Addressed Within The Framework Of Banking Law?

Yes, Customer Data Privacy concerns are addressed within the Framework of Banking Law. These rules acknowledge the sensitivity of personal and financial information handled by banks and financial organizations. Strong standards and guidelines are thus created to ensure that customer data is handled, stored, and shared securely and privately.

One of the most essential parts of it is how the banking business handles data security and privacy rules. These policies often need organizations to use strong data security procedures to protect client information from unauthorized access, breaches, or theft. It involves encryption, access restrictions, and other technical protections to secure sensitive data.

Banking Law typically requires financial firms to get consumers’ express agreement before collecting, processing, or disclosing their personal information. The permission is necessary for various operations, including creating accounts, executing financial transactions, and marketing using client data. Customers have the right to know how their data is used and whether it is shared with other parties.

Several countries have passed legislation granting consumers the right to view and update personal information kept by banks. Individuals check the correctness of their data and seek adjustments if required. Consumers sometimes have the right to request that their information be deleted in specific situations.

Banking Law requires financial institutions to swiftly inform impacted consumers and regulatory authorities in case of a data breach or unauthorized disclosure. It protects consumers’ interests and fosters openness and responsibility within the sector.

Violations of the rules governing data protection are often subject to harsh fines under these laws. Fines, sanctions, and even criminal charges punish these offenses. It is a powerful barrier to banks and financial organizations prioritizing and investing in comprehensive data privacy protections.