Plugged in blog

Navigating the Energy Storage Investment Tax Credit with IRS Form 3468

Disclaimer: Joule Case and the author of this blog post are not tax experts. This post is for informational purposes only, and it is strongly recommended that you consult your tax advisor or attorney for personalized advice.

The Inflation Reduction Act of 2022, signed into law on August 16, 2022, was a monumental leap forward for energy storage in the United States. A key provision and shift from previous incentives include expanding federal income tax credits for standalone energy storage systems not connected to solar.

The following provides a non-detailed overview of the Energy Storage Investment Tax Credit and the process of claiming it using IRS Form 3468. Again, please note that this is NOT professional advice—merely a guide to help you collaborate with your tax professional.

The Energy Storage Investment Tax Credit, a part of the Inflation Reduction Act of 2022, marks a significant shift in federal incentives for energy storage. It provides a tax credit for a wide range of standalone energy storage, including systems employing lithium-ion batteries currently sold by Joule Case. This expansion is a notable deviation from prior regulations, where such tax credits were only available to storage systems directly paired with solar photovoltaic (PV) installations.

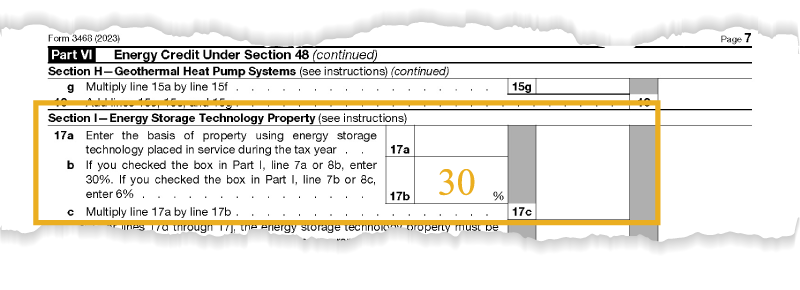

The tax credit can cover up to 30% of the cost of eligible energy storage systems. Significantly, it extends beyond just the storage equipment itself. The credit can encompass related expenses like installation costs, labor, and any additional equipment necessary for the storage system to function. This broader scope significantly enhances the financial feasibility and attractiveness of investing in standalone energy storage solutions.

Individuals or businesses must complete IRS Form 3468 (PDF) to claim this credit. This form is used to claim various investment credits, including the energy credit, which now encompasses the Energy Storage Investment Tax Credit. Maintaining proper documentation and understanding the specific requirements of the property eligible for the creditis essential.

To claim the Energy Storage Investment Tax Credit, follow these steps:

1. Eligibility Assessment - Ensure your energy storage system meets the eligibility criteria for the tax credit. The primary requirement for Joule Case customers is a minimum system size of 5kWh.

2. Maintain Documentation - After you have completed your purchase, make sure you keep detailed records, including:

3. Complete IRS Form 3468:

4. Consult a Tax Professional: Given the complexities of tax credits, it's advisable to consult a tax professional for guidance and to ensure all requirements are met.

5. File Your Tax Return: Attach Form 3468 to your federal tax return.

By following these steps and maintaining proper documentation, individuals and businesses can effectively claim the Energy Storage Investment Tax Credit.

Remember, a tax credit is the ability to subtract a certain dollar amount from the tax amount you owe. These tax credits help reduce your tax burden and reduce your tax liability.

But what if you don’t owe any taxes? Or the amount you owe is less than the amount you are trying to claim?

Well, the Energy Storage Investment Tax Credit, like all Investment Tax Credits, is non-refundable, meaning if the credit is more than the amount you owe, you won’t be getting a refund check from the IRS. Instead, you can carry the remaining balance forward (for up to 22 years) until the reduction to your tax liability offsets the amount of the credit.

The Energy Storage Investment Tax Credit under the Inflation Reduction Act is a landmark change, offering significant financial incentives for energy storage projects. However, navigating the details of IRS Form 3468 and understanding the nuances of the credit are complex. Remember, this blog is not a substitute for professional tax advice. Always consult with a tax professional to ensure compliance and maximize your benefits under this new tax credit.

References: