What are Surety Bonds?

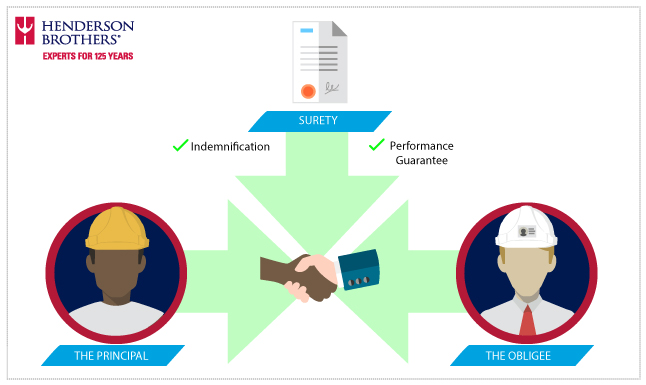

Although bonds are typically handled by insurance agencies, their application and underwriting are unrelated to the insurance process, and will feel much different to someone obtaining a bond for the first time. A surety bond is a written agreement in which an independent party (the Surety) guarantees a second party’s performance (the Principal) to a third party (the Obligee), should the second party fail to fulfill their obligation.

If this all seems confusing, let’s use a simple example: contractors and sub-contractors. Imagine a large contractor is building a very large project, such as a skyscraper; they, in turn, rely on many smaller sub-contractors to complete components such as plumbing or electrical. Here’s where surety bonds become useful: The large contractor (The Obligee) can require a Sub-Contractor (the Principal) to be bonded by an independent party (the Surety) that can guarantee a payout or contract performance if certain contractual conditions of the work are not met. Instead of the large contractor relying solely on the character and reputation of the smaller sub-contractor, they instead require a bond from the sub-contractor against possible increased costs or delays.

How is this Different from Insurance?

Unlike insurance, the principal is not transferring any risk to the surety company. Instead the principal must agree to indemnify the surety for any losses and expenses they may incur when the principal fails to perform their obligation. Insurance companies assume they will pay a certain amount of losses for each insurance policy they sell, where surety companies underwrite to expect no losses.

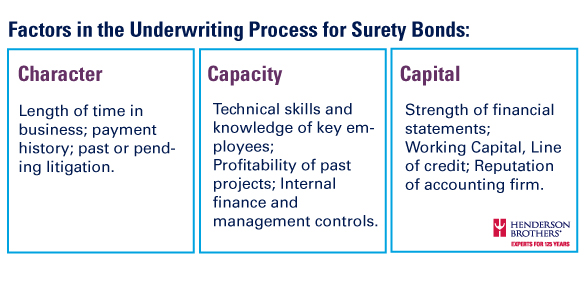

With the idea in mind that Surety Companies do not intend to incur any losses, the underwriting process focuses on the ability of the Principal to meet all of the obligations agreed to in a contract.

This ability is determined by evaluating a Principal’s character, capacity and capital.

Working with a surety specialist and a reputable accounting firm to prepare and present your business to the surety marketplace is essential to securing the best bonding rates and most capacity.

If you have further questions about obtaining bonds or would like to discuss how to better position your Company in the surety marketplace, please contact me today.

Please note that the information contained in this posting is designed to provide authoritative and accurate information, in regard to the subject matter covered. However, it is not provided as legal or tax advice and no representation is made as to the sufficiency for your specific company’s needs. This post should be reviewed by your legal counsel or tax consultant before use.