Investing in publicly traded tire companies will suit value investors who are comfortable with a mature and low-growth industry. However, that shouldn't be interpreted as a slight on the sector. It's a fascinating industry full of the subtle nuances that make up value investing decisions.

If you're looking for a high-growth industry where revenue growth is king, then look away now. However, if you love cheap stocks in an unloved transportation sector, then tire and rubber industry stocks could be for you.

The market

The market

Before going into details of the market's dynamics and how to make money from it, here's a list of some leading tire manufacturers. The top players are a pretty diversified group. It's hard to get an exact fix on profit margins in the industry — measured here in terms of earnings before interest, taxation, depreciation, and amortization (EBITDA) — since some of these companies also have substantive other businesses.

However, one thing is clear — size matters. For example, Bridgestone and Michelin are the two most significant producers and have notably higher margins than smaller players Goodyear and Sumitomo. Only Pirelli (a premium tire manufacturer) is bucking the trend.

This stands to reason since building scale usually matters in manufacturing, particularly in a capital-intensive business such as tire manufacturing. Moreover, larger companies can reduce costs by using their greater purchasing power to negotiate better deals.

Generating cost synergies by building scale was part of the reason behind Goodyear's 2021 purchase of Cooper Tires. The two companies combined generated $17.5 billion in sales in 2019, with an operating income of $1 billion. Still, Goodyear's management believes it can generate $165 million in cost synergy within two years of closing the deal.

The stocks

| Listed Company | Country | Average Sales 2018-2020 | EBITDA Margin 2018-2020 | Notes |

|---|---|---|---|---|

| Bridgestone Corp. (OTC:BRDCY) | Japan | $30,819 million | 14.4% | A global player with around 45% of sales coming from the Americas. Generates 84% of total sales from tires. |

| Group Michelin (OTC:MGDDY) | France | $26,209 million | 18.7% | Diversified tire manufacturer generating 50% of sales from light vehicles, 25% from vans and trucks, and 25% from agriculture, transportation, aerospace, and motorcycles. |

| Goodyear (NASDAQ:GT) | U.S. | $14,180 million | 9.7% | No. 1 in the U.S. Acquired Cooper Tires In 2021. |

| Continental (OTC:CTTA.Y) | Germany | $49,798 million | 11.1% | Tires only comprise around 27% of total company sales. |

| Sumitomo Rubber (OTC:SSUMF) | Japan | $7,813 million | 12.5% | About 84% of sales are from tires. |

| Pirelli (OTC:PLLIF) | Italy | $5,829 million | 23% | Generates around 70% of revenue from high-value tires, so the margin is higher. |

The industry

A mature industry

In a sense, the tire industry is representative of a typical mature, low-growth industry. Typically, such industries are characterized by relatively low growth, emphasizing growth through consolidation and by wringing every bit of operational efficiency from tire and rubber manufacturing. In addition, companies can expand growth in new territories or tire end markets.

For example, the Goodyear/Cooper deal is highly complementary. Cooper was particularly strong in the original equipment market (OEM) in China and the replacement market in the U.S. At the same time, Goodyear was very strong in the U.S. OEM and replacement market.

Consolidation has long been a feature of the industry. Major landmark deals include Bridgestone's purchase of U.S. tire manufacturer Firestone in 1988, Michelin's acquisition of Uniroyal Goodrich in 1989 , and the Goodyear/Cooper deal. In addition, a minor player such as Yokohama Rubber (OTC:YORUF) demonstrated the willingness of tire makers to expand into other categories with its acquisition of Alliance Tire Group (off-highway tires) in 2016.

Low growth is still growth

One interesting facet of the Goodyear/Cooper deal is the 80% of its sales that come from the global replacement market, with 20% from OEM. The last point leads nicely into a key industry point that value investors will appreciate: The industry is not quite as cyclical as you might think.

It's no secret that the key metrics to follow in the industry are global car production and the number of miles driven. OEM tire sales depend on light vehicle production by automotive makers, so when car sales sneeze, tire manufacturers will catch a cold. For the replacement tire market, the key is more cars being driven since more miles driven means more wear and tear on tires.

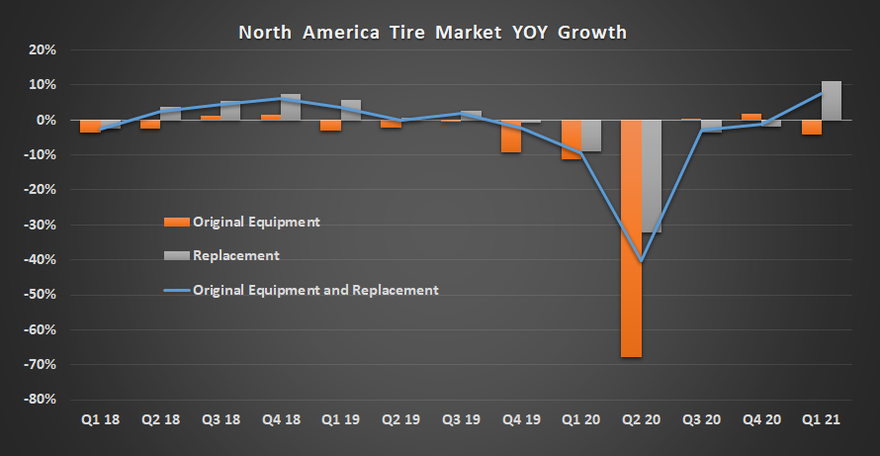

However, the number of miles driven tends to be relatively more resilient — outside of the highly unusual impact of the COVID-19 pandemic in 2020.

The chart below illustrates this point. As car production started to decline in the 2018-2019 period, the OEM tire market in the Americas declined year over year in six of eight quarters in 2018 and 2019. However, growth in the replacement market during the same period helped to offset OEM declines. In fact, the overall tire market held up well until the pandemic hit.

All told, it's reasonable to expect a combination of underlying replacement demand and long-term growth in OEM tire demand to lead to at least low-single-digit revenue growth in the industry.

Cost pressures

Cost pressures

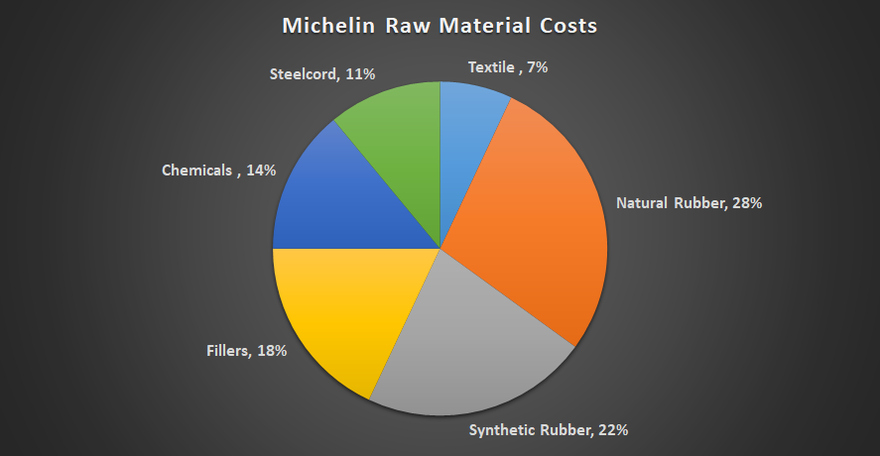

Another way tire manufacturers can improve earnings is through lowering costs. The most variable cost, raw materials, moves with the price of oil. Raw materials make up 36% of Goodyear tires' cost of goods sold, and approximately 67% of that raw material price is "influenced by oil prices."

It's a similar story at Michelin, where only steel cord and natural rubber materials aren't exposed to the price of oil.

Consequently, it's worth keeping an eye on raw materials prices and thinking of tire manufacturers as a group of stocks worth looking at to play an environment of global growth and moderate raw material price inflation.

A sector to invest in

A sector to invest in

The low-growth characteristics mean tire and rubber stocks will never be valued on the kind of earnings multiples that a high-growth software company will command. No matter. There are no prizes for only buying highly rated stocks, and investors can still generate high returns from stocks moving from undervalued to fair value.

That's a consideration that springs to mind when looking at the forward mid-single-digit enterprise value (market cap plus net debt) to EBITDA multiples most of the sector — including Goodyear, Michelin, and Pirelli — trade on.

A combination of steady, if unexciting, long-term revenue growth prospects, plus some margin expansion through ongoing consolidation and cost-cutting, could generate excellent returns for investors over the long term. That argument should resonate with Goodyear investors as the company builds scale and plays catch-up with Bridgestone and Michelin on margin.