CIF is an international trade term used to denote the responsibilities of parties involved in shipping goods. It is one of the Incoterms (International Commercial Terms) established by the International Chamber of Commerce. Under a CIF agreement, the seller is responsible for arranging and paying for transporting goods by sea to a destination port. The seller is also responsible for procuring and paying for insurance coverage against the buyer's risk of loss or damage to the goods during transport. The seller's obligations are fulfilled when the goods are delivered to the carrier or another person nominated by the seller at the named destination. The CIF term is used exclusively in sea freight and includes all costs up to the destination port. However, once the goods are unloaded at the destination port, the risk transfers to the buyer, who is responsible for import duties, taxes, and other costs associated with transporting the goods to their final destination. It's important to note that while CIF includes insurance, the coverage is usually minimal. If the buyer desires more protection, they must either arrange additional insurance or negotiate different terms with the seller. The 'Cost' in CIF encapsulates the total cost of goods and all expenses incurred until the goods are loaded onto the ship. This includes export costs, transportation costs to the loading port, and documentation fees. For instance, if a manufacturer in Germany is shipping automotive parts to Canada, the cost would encompass the price of the parts, the transportation cost from the factory to the German port, and the fees for preparing export documents. The 'Insurance' component of CIF refers to the marine insurance policy that the seller must procure to protect against the risk of loss or damage to the goods during sea transport. The insurance policy should cover the cost of the goods plus 10% to account for potential additional expenses. The types of risks covered can vary but typically include damage from incidents such as fire, ship collision, and natural disasters. The 'Freight' in CIF refers to the cost of transporting the goods from the loading port to the destination port. The seller bears this cost and includes fees payable to the freight forwarder or shipping line. The freight cost depends on various factors, including the mode of transport (sea, air, rail, or road), the type of goods, and the distance between the ports. CIF offers several advantages. It simplifies pricing for buyers, as they receive a single price that includes the cost of goods, insurance, and freight. It also provides risk management for sellers, as they control the insurance and shipping arrangements. Furthermore, CIF streamlines documentation, as the seller is responsible for providing all necessary documents. However, CIF also has its disadvantages. It offers limited flexibility for buyers with little control over the insurance and shipping arrangements. There may also be potential hidden costs, such as high insurance premiums or freight charges. Moreover, CIF is unsuitable for all modes of transport; it is designed primarily for sea and inland waterway transport. In a CIF contract, the terms are negotiated between the buyer and seller. These terms define the responsibilities of each party and determine the payment methods. For instance, the seller may agree to bear all costs until the goods reach the destination port, while the buyer may agree to pay upon receipt of the shipping documents. The documentation in a CIF transaction typically includes a commercial invoice, a bill of lading, a certificate of insurance, and export/import documents. The commercial invoice details the cost of goods, the insurance premium, and the freight charges. The bill of lading serves as a receipt for the goods, a contract of carriage, and a document of title. The certificate of insurance provides evidence of the insurance coverage. There are several alternatives to CIF, each with its own set of responsibilities for the buyer and seller. These include: Ex Works (EXW): The buyer is responsible for all costs and risks from the seller's premises to the destination. Free on Board (FOB): The seller is responsible for the cost and risk until the goods are loaded on board the ship. Carriage Paid To (CPT): The seller pays for carriage to the named place of destination but risk transfers upon delivery to the first carrier. Carriage and Insurance Paid To (CIP): The seller pays for carriage and insurance to the named place of destination, but risk transfers upon delivery to the first carrier. Each of these Incoterms has its own advantages and disadvantages, and the choice depends on the specific circumstances of the transaction. CIF transactions are subject to various laws and regulations, both domestic and international. These laws govern the obligations of the buyer and seller, the terms of the insurance contract, and the carriage of goods. In case of disputes, the resolution may involve litigation or arbitration, depending on the terms of the contract. Compliance with international standards is also crucial in CIF transactions. For example, the International Chamber of Commerce (ICC) publishes the Incoterms rules, which define the responsibilities of buyers and sellers in international trade. These rules are widely recognized and used in international contracts. Cost, Insurance, and Freight is an international trade term that defines the responsibilities of parties involved in shipping goods. It involves the seller arranging and paying for the transportation of goods by sea, procuring insurance coverage, and delivering the goods to the destination port. CIF simplifies pricing and provides risk management for sellers but offers limited flexibility for buyers. It is primarily designed for sea and inland waterway transport. CIF transactions require careful documentation, including commercial invoices, bills of lading, and certificates of insurance. Alternatives to CIF include Ex Works, Free on Board, Carriage Paid To, and Carriage and Insurance Paid To. Such transactions are subject to various laws and regulations, and compliance with international standards, such as the Incoterms rules, is essential.What Is Cost, Insurance, and Freight (CIF)?

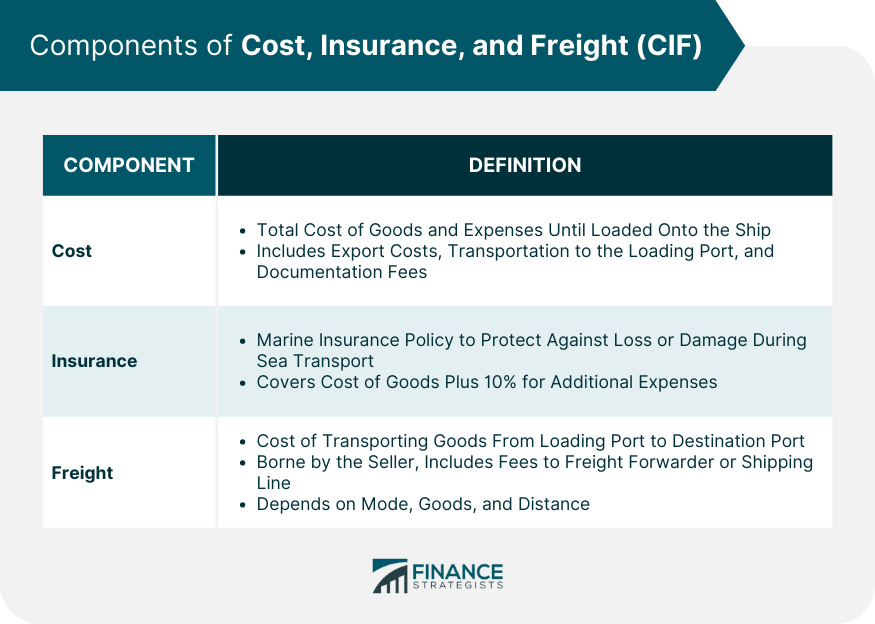

Components of CIF

Cost

Insurance

Freight

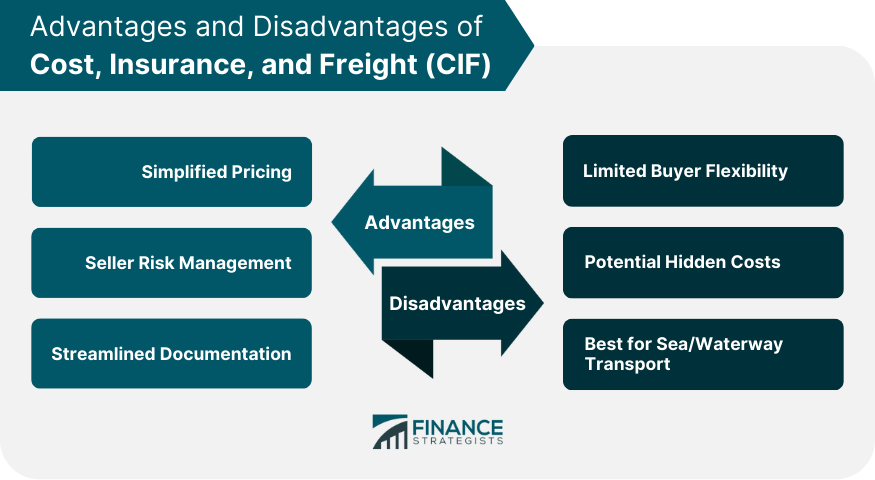

Advantages and Disadvantages of Cost, Insurance, and Freight

Cost, Insurance, and Freight (CIF) in Practice

Alternatives to Cost, Insurance, and Freight (CIF)

Legal Considerations for Cost, Insurance, and Freight (CIF)

Conclusion

Cost, Insurance, and Freight (CIF) FAQs

Cost, Insurance, and Freight (CIF) is an international trade term that denotes the seller's responsibilities in the shipping process. Under a CIF agreement, the seller is obligated to arrange and pay for the transportation of goods by sea and procure insurance coverage against the buyer's risk of loss or damage during transport.

CIF differs from other Incoterms in requiring the seller to bear the cost of the goods, the marine insurance, and the freight charges to the destination port. This is unlike terms such as Ex Works (EXW) or Free on Board (FOB), where the buyer assumes more responsibility for the costs and risks associated with transporting goods.

Under a CIF agreement, the seller is responsible for procuring and paying for insurance coverage against the buyer's risk of loss or damage to the goods during sea transport. However, the coverage is typically minimal, and the buyer may need to arrange additional insurance for more protection.

CIF offers several advantages, such as simplified buyer pricing and risk management for sellers. However, it also has potential disadvantages. Buyers have limited control over insurance and shipping arrangements, and hidden costs may exist. Moreover, CIF is primarily designed for sea and inland waterway transport, making it unsuitable for other modes of transport.

If goods are damaged during transport under a CIF agreement, the insurance coverage procured by the seller should provide compensation. However, the coverage under CIF is usually minimal. If the buyer anticipates a higher risk of damage or loss, they should consider arranging additional insurance or negotiating different terms with the seller.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.