Press Release

The fiscal reforms implemented in recent years have been reflected in the moderate growth of tax collection levels in Latin American countries. Nevertheless, in most of them, the fiscal burden is still low with respect to their development levels and, as ECLAC has shown in recent reports, tax systems maintain a regressive bias because direct taxes do not generate enough fiscal income to have an important impact on redistribution. This outcome is mainly due to the low level of effective taxation rates in Latin America, especially in the high-income decile.

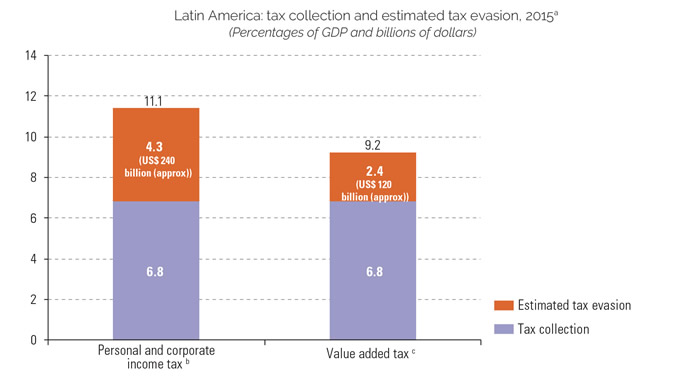

That is why tax evasion constitutes one of the main weak spots in Latin American economies. ECLAC estimates that in 2015 it grew to an amount equivalent to 2.4 percentage points of the regional Gross Domestic Product (GDP) in the case of the Value-Added Tax (VAT) and 4.3 points of GDP in the case of income tax, to total $340 billion dollars (6.7% of GDP overall).

This is according to the Economic Survey of Latin America and the Caribbean 2016, one of ECLAC’s main annual publications, the most recent of which was released in late July. The document states that tax evasion on corporate and personal income exceeds 60% in some countries. In addition, reducing those indicators in an environment of less economic dynamism is seen as being markedly difficult and, what’s worse, there is insufficient information available to quantify the magnitude of the problem, despite the huge risk of suffering a substantial loss of potential fiscal resources.

To fight evasion, ECLAC says that administrative changes in countries’ tax structures are needed to improve collection and progressiveness, given the high levels of informality, poverty and socioeconomic inequality, poor institutional quality, and taxpayers’ low degree of fiscal consciousness and education.

The other evasion: illicit international trade flows

Tax evasion is not limited to the domestic sphere. The more a country is inserted in the global economy, the bigger the possible erosion of their tax base is. In that sense, illicit financial flows stemming from international trade also constitute an important source of lost fiscal resources, the report adds.

According to ECLAC’s estimates, these illicit flows—meaning outflows of resources derived from the manipulation of international trade prices—represented 1.8% of the regional GDP ($765 billion dollars) in the accumulated period from 2004 to 2013. Two-thirds of that figure came from overbilling imports and one-third from underbilling exports.

The study says that most illicit flows arise in transactions with the United States (38% of the accumulated flows in the period analyzed) and China (19%). In terms of products, the main losses were recorded in two sectors: electric machinery (including computers), and nuclear reactors, boilers, machines and others (including integrated circuits).

Given the current international context, to fight this kind of evasion cooperation mechanisms between countries and regional blocs must be strengthened, and to that end multilateral organizations can serve as spaces for reaching agreements and consensus. This would be of great benefit for Latin American and Caribbean nations, the report indicates.