The near-term economic outlook for investment-grade (IG) corporate bonds appears quite challenging at present.

The asset class was already facing an environment of slowing global growth and high inflation, along with a much less favorable outlook for monetary policy. The Ukraine conflict therefore couldn't have come at worse time, as it further weakened the growth outlook and pushed inflation even higher due to surging commodity prices.

However, we think there are some important countervailing factors, which at least support an overall neutral stance for the asset class. At the same time, we explain why the current environment calls for a high degree of selectivity.

Significantly increased yield compensation

An important change is that the all-in yield, and therefore the initial expected level of income attainable from holding IG bonds, has increased significantly. For example, in the case of the widely followed Barclays Bloomberg Global Corporates – Aggregate Index, the current yield of 3.39% is 79% higher than the 1.89% at the end of 2021, and 149% higher than the 1.34% at the end of 2020.1

Of course, this higher yield level essentially reflects the increase in return needed to compensate for the negative factors of higher inflation, rising interest rates and weakening global growth. Still, the level of income available has increased significantly and could represent a more attractive entry point for long-term investors.

Solid fundamentals

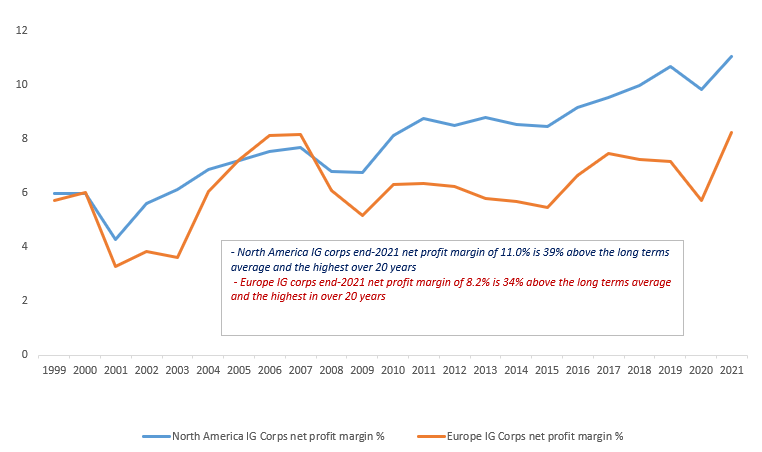

Importantly, while there are notable sectoral and regional variations, as a whole, IG corporate fundamentals remain strong, suggesting contained credit risk. Helped by the post-Covid-19 global economic recovery, net profit margins stand near all-time highs, liquidity remains strong and debt-servicing capacity is near the strongest it has been since the late 1990s. Less favorably, net and gross leverage ratios are still above the long term average, but even here the general trend over the last few years has been downward.2

North America and European IG corporates net profit margin %

Source: Global Credit Trader, Goldman Sachs, March 24, 2022

Differentiation is key — US vs. Europe

While increased yields and solid fundamentals may help to offset other less favorable external factors, in the current environment, differentiation within the global IG market will matter more than ever. In this regard, an important broad distinction can be made between US and European economies at present. In general, Europe is much more exposed to the Ukraine conflict. This is because it relies quite heavily on Russia for its energy imports, with which it also has significant other trade and financial links.

While increased yields and solid fundamentals may help to offset other less favorable external factors, in the current environment, differentiation within the global IG market will matter more than ever.

By contrast, the US is in a much better position compared to Europe. This is because only around 5% of its (now banned) oil imports came from Russia, and, furthermore, the US is now a net exporter of oil and gas thanks to the fracking revolution. While higher oil prices have hit US consumers, sensitivity to this has decreased over time and pandemic-related savings, albeit unevenly distributed, should provide some cushioning. Additionally, since the US is a net energy exporter, there could also be a positive growth impact from higher oil prices feeding through to higher domestic investment in new production.

Sectoral implications of the Ukraine conflict

Aside from regional variations, the current backdrop of the Ukraine conflict and generally increasing geopolitical tensions also have some important sectoral implications. Unsurprisingly, surging prices have been supportive for companies in the energy sector in the short run. This again is relatively more favorable for the US IG corporate bond market due its higher energy sector weighting. However, beyond this, in the longer run too, US energy companies, particularly shale gas producers, could be major beneficiaries of European efforts to redirect energy demand away from Russia.

Another sector likely to be heavily impacted by recent events is defense. The close proximity and shock of the Ukraine war seems very likely to increase defense spending in European countries in coming years. Further, while a lot attention has focused on Russia’s global energy supply contribution, as shown below, it is also a leading global supplier of other commodities, including palladium, wheat and platinum. With sanctions also curtailing Russian supply of such items to Western markets, companies that can fill the supply shortfall may benefit.

Russia’s share in global commodity production (%)

| 2018 | 2019 | 2020 | |

|---|---|---|---|

| Oil | 12.2 | 12.3 | 12.1 |

| Natural gas | 17.4 | 17.1 | 16.6 |

| Coal | 5.6 | 5.5 | 5.2 |

| Copper | 4.3 | 4.3 | 4.3 |

| Aluminium | 5.9 | 6.2 | 6.1 |

| Nickel | 6.8 | 6.3 | 6.1 |

| Zinc | 1.9 | 1.5 | 1.5 |

| Gold | 8.5 | 9.1 | 9.5 |

| Silver | 5.1 | 5.3 | 5.4 |

| Platinum | 10.8 | 11.7 | 14.1 |

| Palladium | 39.4 | 41.9 | 43.9 |

| Wheat | 9.8 | 9.7 | 11 |

Source: JP Morgan Research, March 2022

Conclusion

IG credit markets are contending with a challenging environment of higher inflation, more hawkish central banks and a war in Europe that is worsening the global economic outlook. However, the good news is that yields and spreads have increased substantially, bringing value back into the asset class. At the same time, corporate fundamentals remain strong. For defensive-minded, income-oriented investors especially, the relatively low risk part of the credit spectrum may therefore seem appealing at the present time.

On balance though, we think a neutral stance to the asset class is reasonable. That said, within this broader view, there are numerous dynamics and trends at the geographic, sector and security level that prudent investors may wish to explore.

References

1. ‘Bloomberg Barclays Global Aggregate – Corporates’ Index, as of 12 April 2022

2. ‘Global Credit Trader’, Goldman Sachs, 24 March 2022

IMPORTANT INFORMATION

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in the market value of an investment), credit (changes in the financial condition of the issuer, borrower, counterparty, or underlying collateral), prepayment (debt issuers may repay or refinance their loans or obligations earlier than anticipated), call (some bonds allow the issuer to call a bond for redemption before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

Foreign securities are more volatile, harder to price and less liquid than U.S. securities. They are subject to different accounting and regulatory standards, and political and economic risks. These risks are enhanced in emerging markets countries.

Trading in commodities entails a substantial risk of loss. Commodities generally are volatile and are not suitable for all investors. The commodities markets and the prices of various commodities may fluctuate widely based on a variety of factors.

US-280422-170126-1