This post may contain affiliate links. Please read our disclaimer for more information.

An accounting ledger is a simple, cost-effective tool for keeping tabs on cash flow. While accounting ledgers are traditionally used by accountants as an aid for tax season, small businesses can also use accounting ledgers to help stay organized and plan ahead. If you own or manage a business, this indispensable accounting tool will help you protect your bottom line.

As a small business owner, you may be used to keeping track of your finances with a personal checkbook or budget. However, as your business grows, you’ll need a more sophisticated system to manage your cash flow. This is where accounting ledgers come in.

An accounting ledger is essentially a record of all financial transactions made by a business. This includes income, expenses, assets, liabilities, and equity. Accounting ledgers can be used to produce financial statements, tax returns, and other reports.

While you can hire an accountant to maintain your accounting ledger, it’s not necessarily a requirement. Small businesses can often get by with a simple Excel spreadsheet or other software program. However, as your business grows, you may need to upgrade to more sophisticated accounting software.

No matter what system you use, keeping accurate records is essential for the success of your small business. Accounting ledgers can help you track your income and expenses, identify trends, and make informed decisions about where to allocate your resources. If you’re not already using one, now is the time to start.

There is no one-size-fits-all solution for small business accounting. The type of system you use will depend on the size and complexity of your business. However, there are some basic principles that all small businesses should follow.

First and foremost, you should keep accurate records of all financial transactions. This means recording income, expenses, assets, liabilities, and equity on a regular basis. Doing so will help you stay organized and make it easier to produce financial statements and other reports.

Second, you should use accounting ledgers to track your cash flow. This will help you identify trends and make informed decisions about where to allocate your resources.

Last but not least, you should use accounting ledgers to produce financial statements. Financial statements can be used to track your progress, assess your financial health, and make informed decisions about the future of your business.

Accounting ledgers are a simple, cost-effective way to keep tabs on your small business finances. By recording income, expenses, assets, liabilities, and equity on a regular basis, you can stay organized and make informed decisions about where to allocate your resources. If you’re not already using one, now is the time to start.

Benefits of Accounting Ledgers

1. An accounting ledger is a great way to keep track of your income and expenses.

When you keep all of your financial information in one place, it’s easy to see where your business stands at any given time. With an accounting ledger, you can review your income and expenses on a monthly or yearly basis, making it easier to budget and plan for the future.

2. An accounting ledger can help you spot accounting errors.

If you’re not keeping track of your finances in an accounting ledger, accounting mistakes can go unnoticed until it’s too late. An accounting ledger can help you catch any errors that may have been made in your bookkeeping, so you can correct them quickly and avoid any costly mistakes.

3. An accounting ledger is a great way to prepare for tax time.

No one looks forward to tax time, but an accounting ledger can make the process a lot less daunting. By keeping track of your income and expenses throughout the year, you’ll have all the information you need to file your taxes accurately and on time.

4. An accounting ledger is a great way to monitor your business’s financial health.

An accounting ledger can help you keep an eye on your business’s cash flow, so you can make informed decisions about where to invest your money. When you have a clear understanding of your company’s financial status, you can make sound decisions that will benefit your business in the long run.

5. An accounting ledger is a versatile tool that can be adapted to any business.

Whether you’re a small business owner or an accountant, an accounting ledger is a great way to keep track of your finances. This simple, versatile tool can be adapted to any type of business and is quick and easy to add entries.

An accounting ledger is an essential tool for small businesses. By keeping track of your income and expenses, you can protect your bottom line and make informed decisions about the future of your business. An accounting ledger is a simple, cost-effective way to stay organized and prepared for tax time.

If you own or manage a business, this indispensable tool will help you monitor your company’s financial health and make sound decisions about where to invest your money.

Still not sure? Check out our blog post all about accounting ledgers to see if you might benefit from using one for your small business.

Check out our accounting ledgers below available to buy now from Amazon or our printable accounting ledgers are available to buy now in our Etsy shop.

Accounting Ledgers

Pale Pink & Rose Gold Ledger

Simple Black Ledger

Kraft Accounting Ledger

Black & Gold Ledger

Accounting Ledgers

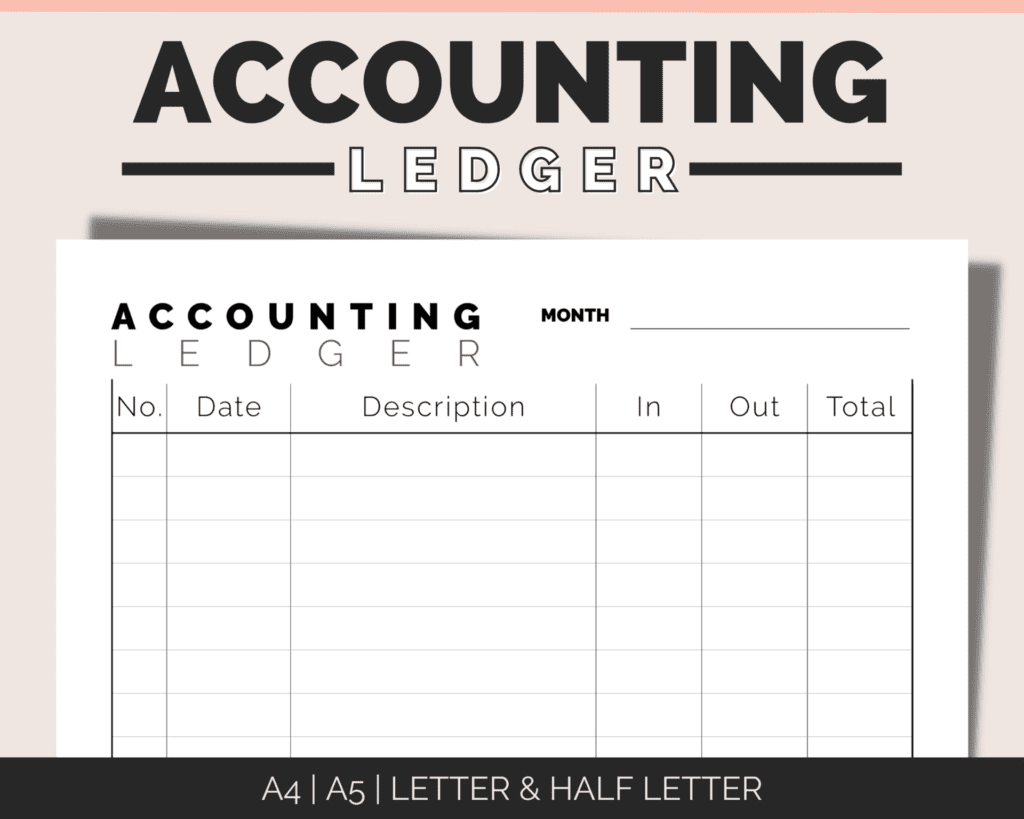

Our accounting ledgers are designed to make tracking your finances easy. Our printable accounting ledgers are available to purchase in our Etsy shop.

Accounting Ledger Book

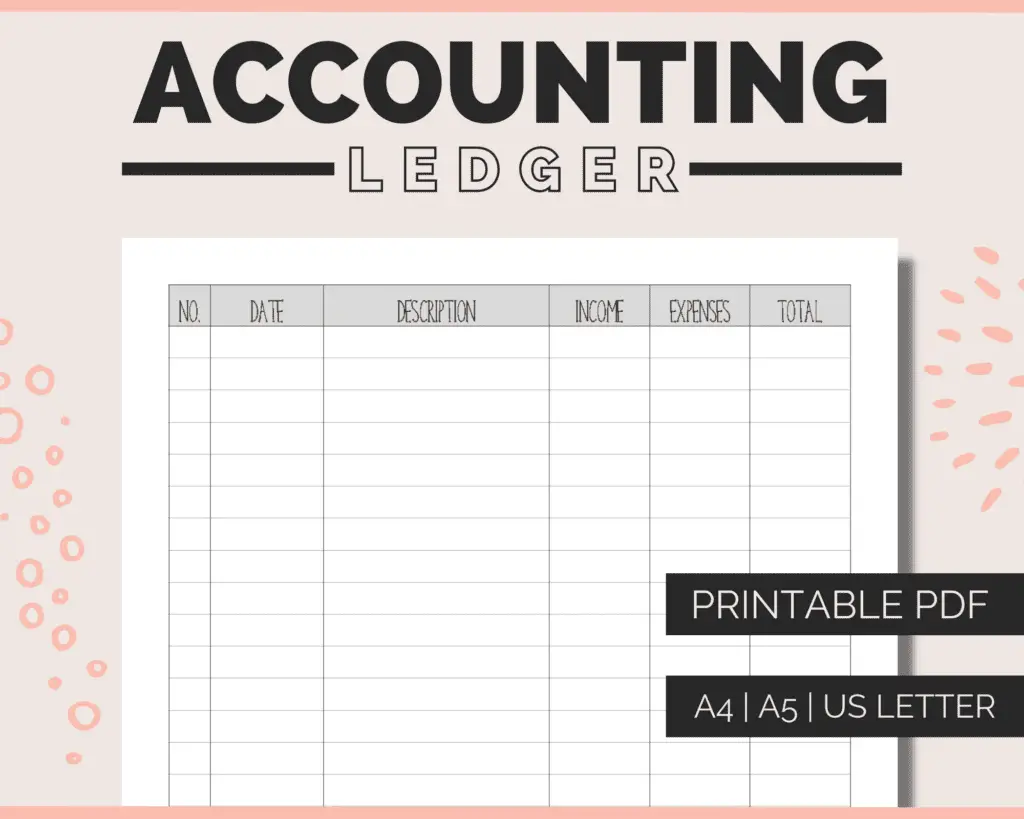

Printable Accounting Ledger