Indemnity bonds guarantee the bond’s owner financial compensation in the event of a covered loss. When a borrower fails to repay a loan by the terms of an agreement, the lender is protected by the bond. Anyone who breaches the terms of a contract will have their business and personal assets liquidated to pay the debt.

One cannot budge on the terms of this bond. Only if the surety bond is signed will it be accepted. An indemnity bond says that the contractor has to pay back the surety for any money paid out on a claim. For example, the surety company will ask the bonded contractor to pay back any costs the surety company had to pay to finish the project (such as paying another contractor). If the contractor doesn’t follow the rules, the surety firm could sue them.

See also:

Indemnity bond: Why do you need indemnity bonds?

A need for an indemnity bond might arise for several different reasons. For instance, whether purchasing a property, business, or shares of stock or dealing with government indemnification programmes.

Bonds required for obtaining a contractor’s licence should also be included. The contractor, the business, and the state bond-issuing body are all protected legally. Professional and ethical project completion is aided by obtaining a contractor licence bond. The most frequent situations that call for Indemnity bonds are those involving the borrowing of money or the transfer of property. In the case of a breach of the contract’s terms, the surety bond is used to compensate all parties involved. Liability results from a breach, and the at-fault party must pay the other’s damages.

Indemnity bonds are another insurance policy that may be taken up between an employer and an employee. The bond guarantees the worker’s continued service to the company for a specific time frame. The employee is obligated to pay damages if the employee quits before the end of the contract period.

Those who misplaced their Share certificates may also create an indemnity bond. The bond certifies the Share certificate has been lost and asks for a replacement to be issued. The bond covers all fees and expenses related to issuing the new share certificate and is repaid to the applicant.

If a school or business has to modify a student’s most basic information, such as their name or address, they may be required to post a bond in the amount of their choice to cover any damages that could be incurred as a result of the change. An indemnity bond may be signed by either a government official or a private contractor. There is a wide range of transactions for which these bonds can be used as legal recourse.

Indemnity bond: Characteristics

- Based on mutual trust between the parties, this agreement serves as a framework for future interactions.

- Only compensates for losses directly related to the occurrences specifically listed in the contract. The promisee’s responsibility is limited to such occurrences.

- Anything that is taken into account must hold up in a court of law. The bond’s conditions must comply with applicable laws.

Indemnity bond: Benefits

- Surety bonds, often known as indemnity bonds, cover financial losses. The bond safeguards the obligor against financial loss if the principal does not fulfil its contractual duties.

- Any foreseeable loss may be accounted for by modifying the terms of the indemnity bond. In the event of a dispute, both parties to the contract will have an understanding of the terms of payment.

- These bonds cover all damages incurred due to criminal behaviour.

- Principals who sign indemnity agreements commit to bearing all costs associated with bond claims. Thus, they, not the surety, are responsible for all fees.

- Without a payment assurance system, trade and other kinds of business activity cannot occur. The guarantor has pledged to protect the debt if the debtor defaults on his obligations under the contract.

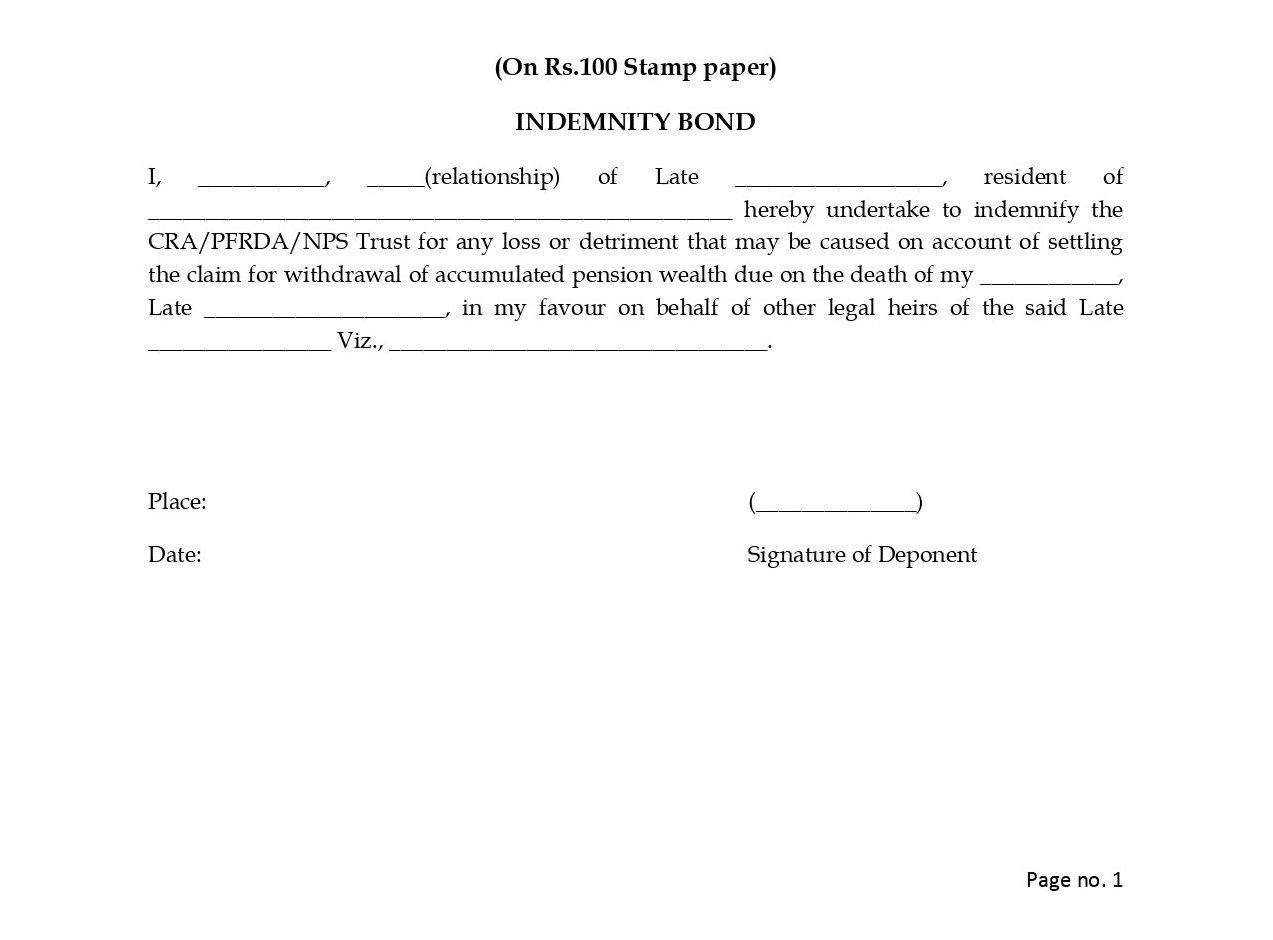

Indemnity bond: Sample

FAQs

How much does a bond of indemnity cost?

Indemnity bonds demand stamp duty payments in line with the Indian Stamp Act 1899 and the stamp duty rules of the relevant states and union territories. The charges are three percent of the security's value, up to a maximum of one hundred rupees.

What is an indemnity bond for a fixed deposit?

Similarly to an insurance policy, an indemnity bond for loss of FD receipt compensates the bank for losses it may have sustained due to claims made against it. And it protects the bank against any claims or legal actions that could be made against it.

| Got any questions or point of view on our article? We would love to hear from you.

Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

Housing News Desk is the news desk of leading online real estate portal, Housing.com. Housing News Desk focuses on a variety of topics such as real estate laws, taxes, current news, property trends, home loans, rentals, décor, green homes, home improvement, etc. The main objective of the news desk, is to cover the real estate sector from the perspective of providing information that is useful to the end-user.

Facebook: https://www.facebook.com/housing.com/

Twitter: https://twitter.com/Housing

Email: [email protected]