Guest blog by Tariq Alsuwaidi, LEG’23

The realization that addressing inflation is essential to achieving sustainable economic development is one of the most important things that may be gained from taking this course. For instance, the United Arab Emirates (UAE) has suffered from the negative impacts of excessive inflation, such as a drop in buying power, a reduction in the global competitiveness of sectors, and the possibility of societal unrest.

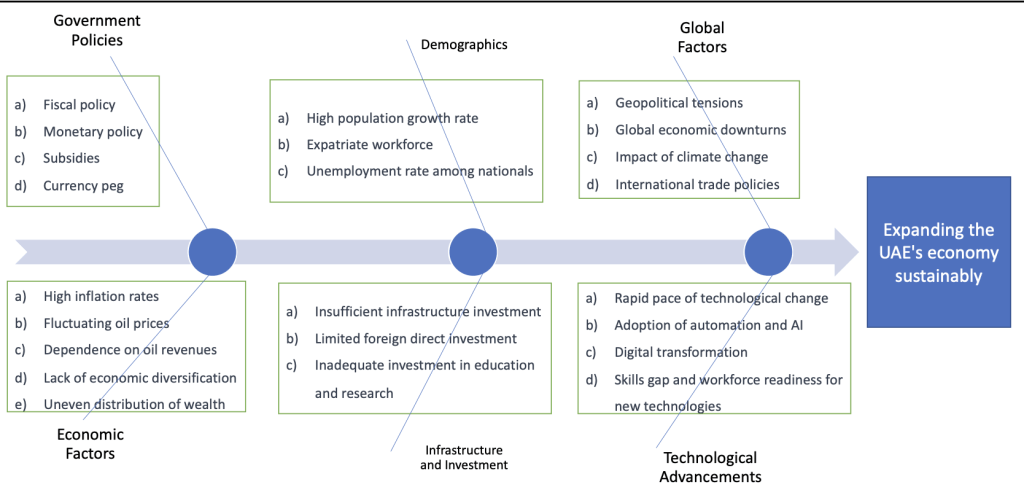

To solve this issue, a fishbone diagram has been proposed as a method for determining the probable reasons of the growth problem as well as the remedies to this issue. Promoting economic diversification as a means of mitigating the dangers of over-dependence on income derived from hydrocarbons and executing prudent monetary and fiscal policies as a means of maintaining price stability are the primary entry points for policy action. Both are necessary in order to keep prices stable. The United Arab Emirates has the capacity to generate economic stability and sustained development via the use of such policies.

During the 10-week period, significant progress was made in identifying and resolving the UAE’s economy’s limiting factor and its inflation problem. The need to consider the unique characteristics of the UAE’s economy is a critical insight, as policies that have been successful in other countries may not necessarily be effective in this context. In addition, benchmarking exercises must be approached with caution due to the limitations of aggregated data and the potential influence of currency exchange rates and global economic conditions. Therefore, it may be more appropriate to use pricing signals, such as interest rates, real estate prices, currency rates, wage growth, and commodity prices, to identify the constraining factor in the UAE’s economy and develop inflation-fighting programs.

Furthermore, Ricardo’s preference for price signals over quantity indicators provides useful insight into the role of supply-side constraints in inflation. In an economy dependent on natural resources such as the UAE, fluctuations in commodity prices may have a significant impact on inflation rates. Therefore, policymakers must closely monitor commodity prices and eliminate supply-side restrictions that may increase input costs and production costs. Overall, the identification of these crucial factors and indicators demonstrates the need for a nuanced and individualized strategy to combat inflation in the UAE’s economy.

I would like to use the information I’ve learned in this course to assist me in pursuing my academic and professional aspirations. I want to use the problem-solving frameworks and analytical approaches I gained in this course to handle growth concerns and execute successful policies across several domains. Furthermore, the critical thinking and communication skills I’ve gained in this course will help me analyze complicated challenges, effectively communicate my ideas, and collaborate with varied teams to accomplish shared objectives.

This is a blog series written by the alumni of the Leading Economic Growth Executive Education Program at the Harvard Kennedy School. 72 Participants successfully completed this 10-week online course in May 2023. These are their learning journey stories.